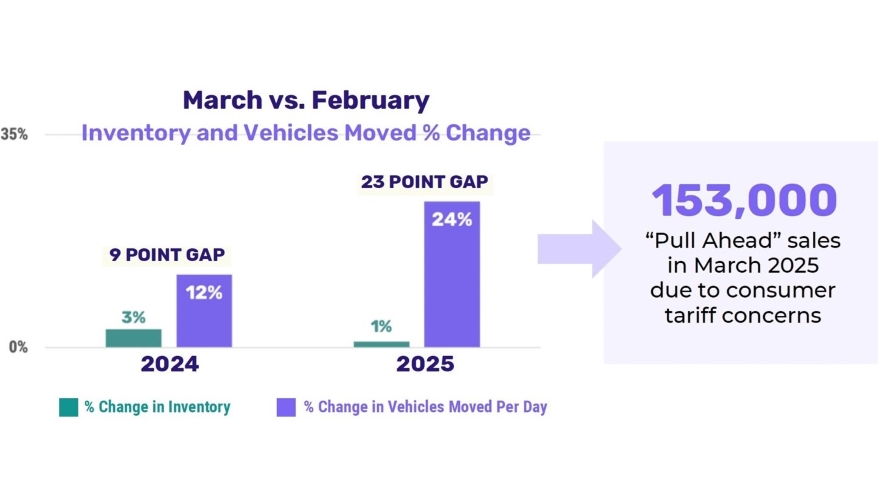

Tariff fears led to 153,000 ‘pull ahead’ sales in March, report says

Image courtesy of Cloud Theory.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Concerns about the coming auto tariffs sent car shoppers racing to dealerships in March, according to a report by Cloud Theory.

The automotive data analytics firm’s quarterly “On the Horizon” report found the consumer fears about the potential impact of the tariffs, implemented April 3, led to an additional 153,000 new vehicle sales last month.

The report showed new vehicle movement jumped 38% for the month, rising from about 960,000 units in February to some 1.31 million in March. While some of that increase was the result of typical seasonal cycles and tax refunds, Cloud Theory said “a significant portion” was related to consumer tariff concerns.

“Consumers are well aware of the risks these tariffs pose in terms of future cost hikes, with price increases potentially moving from the hundreds of dollars to the thousands,” Cloud Theory vice president of data science and analytics Rick Wainschel said. “Consumers, in anticipation of those higher prices, rushed to buy new vehicles in the current period.

“While that provided a boost in the short run, the ‘pull-ahead’ effect of the accelerated sales runs the risk of leading to a hangover effect that depresses results going forward.”

New vehicle prices were already showing a sharp increase before the auto tariffs went into effect, the report said, noting the average marketed price shot up by $1,123 from Feb. 23 to March 31, with prices rising daily.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The segments leading that price hike were the largest vehicles — extra large SUVs, full size pickups and heavy-duty trucks — which, the Cloud Theory said, is not a coincidence. Their V8 engines come primarily from Canada, and the company said those segments are “an early harbinger of dynamics to come as costs (even threatened ones) get passed from the OEM to the dealer to the consumer.”

The report also found manufacturers were scaling back on discounts and incentives in March, with Cloud Theory’s Market Adjustment metric showing a decline of $432 from the end of February to the end of March.

“The industry is contending with the potential of much higher costs, which will trigger much higher prices for consumers going forward,” Wainschel said. “While this led to very strong results in the short term as consumers got ahead of the price increase curve, the longer-term effects will likely be highly detrimental to industry prospects. And if the tariffs become entrenched and trigger an all-out trade war, marketplace dynamics could quickly go from worrisome to catastrophic.”

The full report is available here.