Why there still are some negative jolts when it comes to retailing EVs

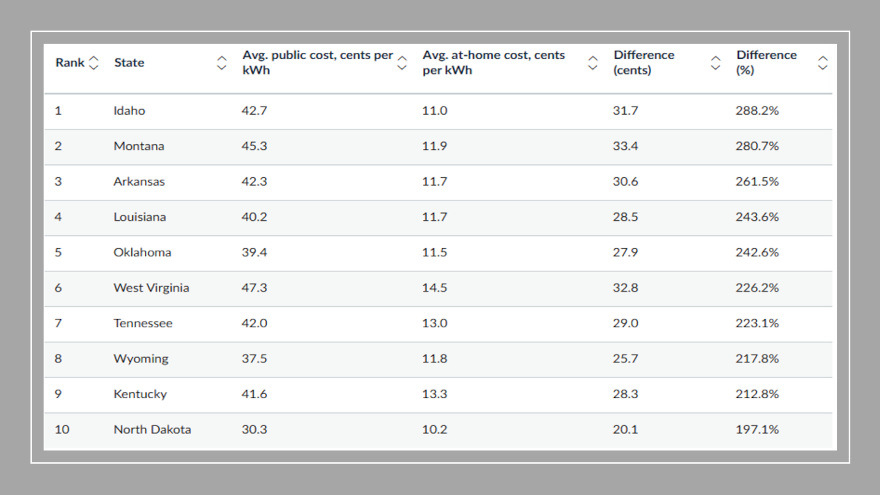

This chart shows states with the biggest discrepancies in public and at-home EV charging costs. Courtesy of LendingTree.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Retailing used electric vehicles should be plug-and-play easy for dealers, right? Especially since the latest research from iSeeCars shows used EV prices fell 15.1% over the past year, perhaps making those vehicles some of the most appealing units in your inventory.

Well, Cox Automotive’s Q1 2025 Dealer Sentiment Index (CADSI) indicated that dealerships aren’t necessarily fully charged about retailing EVs. And that might be in part to the surge in costs that EV owners are experiencing to keep their vehicles charged that LendingTree discovered.

Cox Automotive acknowledged dealers’ views on EV sales improved in Q1 compared to the previous quarter and last year. However, at an index of 47, researchers said many dealers feel EV sales are worse now than a year ago.

The index showed franchised dealers scored 51, up from 43 last year, marking their highest score since Q3 2023.

Independent dealers also saw an improvement over the past year and last quarter, but their score of 45 indicates more believe sales are worse now than a year ago, according to the Cox Automotive survey.

Cox Automotive pointed out that expectations for the electric vehicle market rose in Q1. However, researchers explained that a score of 40 indicates that most dealers anticipate the electric vehicle market will decline, rather than grow, over the next three months.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Despite this, dealers continue to view the electric vehicle tax credit favorably, citing its benefits for both dealerships and sales,” Cox Automotive said in a news release that accompanied the index. “Notably, scores for franchised dealers dropped from a record high of 67 last quarter to 64 this quarter.

“Overall sentiment also saw a slight decrease from 60 to 59. Nevertheless, a score of 59 still reflects that a majority of auto dealers believe the electric vehicle tax credit is positively influencing EV sales,” Cox Automotive continued.

Meanwhile, LendingTree emphasized that understanding the reality of charging costs is becoming increasingly vital.

LendingTree’s latest data release revealed a significant cost disparity for EV owners, with home charging averaging only 16.3 cents per kWh, compared to public stations that charge as much as 34.2 cents per kWh — more than twice the price.

Additional datapoints from the LendingTree research included:

—Cost of public charging: The most expensive states per kWh are Hawaii (55.8 cents), West Virginia (47.3 cents), and Montana (45.3 cents). The least expensive states are Kansas (22.0 cents), Nebraska (24.6 cents), and Missouri and Maryland (25.4 cents).

—Cost of home charging: The most expensive states per kWh are Hawaii (42.3 cents), Massachusetts (31.2 cents), and California (30.6 cents). The least expensive states are North Dakota (10.2 cents), Nebraska (10.8 cents), and Idaho and Utah (11.0 cents).

LendingTree also determined public charging costs 288.2% more than home charging in Idaho, followed by Montana (280.7%) and Arkansas (261.5%). Researchers noticed Massachusetts has the smallest gap, with public charging just 2.9% pricier than home electricity, followed by California (15.4%) and Hawaii (31.9%).

LendingTree’s chief consumer finance analyst Matt Schulz stressed the importance of understanding these costs.

“While the initial investment in an electric vehicle can be higher, the long-term savings, particularly in fueling and maintenance, are substantial. Our research indicates that home charging offers the most cost-effective solution for EV owners, underscoring the need for accessible residential charging infrastructure,” Schulz said.

The full LendingTree report is available at LendingTree.com/auto/cost-charge-ev.