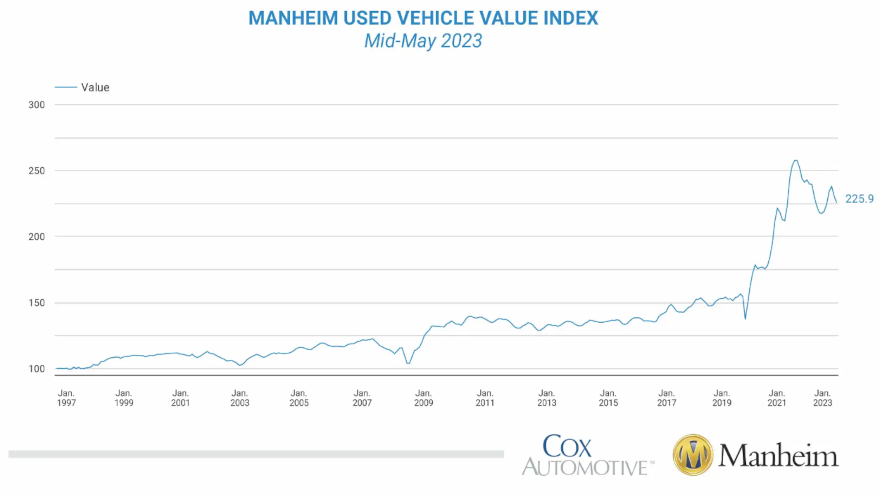

‘Seasonal adjustment’ pushes Manheim Index lower at May midpoint

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

This week’s flow of industry data continued with Cox Automotive reporting wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) decreased 2.1% from April during the first 15 days of May.

As a result, Cox Automotive said the midmonth Manheim Used Vehicle Value Index dropped to 225.9, which was down 7.0% from last May, prompting analysts to say, “the seasonal adjustment contributed to the decline.”

Analysts mentioned in a Data Point that the non-adjusted price change in the first half of May declined 0.9% compared to April, while the unadjusted price was down 7.5% year-over-year.

Cox Automotive’s latest look at the Manheim Used Vehicle Value Index arrived in the same timeframe as Black Book’s weekly look at wholesale prices as well as S&P Indices and Experian giving their monthly view of auto finance defaults.

Over the last two weeks, Cox Automotive said Manheim Market Report (MMR) prices were nearly unchanged compared to the end of April.

“Prices in the first two weeks of May have been generally flat over the last four years,” analysts said, noting that average changes have been between a drop of 0.1% and a rise 0.1% since 2019.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

During the first 15 days of May, Cox Automotive pointed out that MMR Retention — the average difference in price relative to current MMR — averaged 99%, indicating that valuation models remain slightly ahead of market prices.

Analysts also mentioned the average daily sales conversion rate of 59.5% during the first half of May declined relative to April’s daily average of 60.3% and was below the May 2019 daily average of 59.9%.

Cox Automotive went on to state that all eight major market segments posted seasonally adjusted prices again lower year-over-year in the first half of May.

Analysts noticed that only prices for pickups and compact cars — which softened 3.9% and 6.6%, respectively — declined less compared to the overall industry in seasonally adjusted year-over-year changes. The remaining segments decreased between 7.4% and 14.3%, with sports cars dropping the most.

Seven of the eight major segments saw price decreases compared to April, with losses ranging from 1.7% to 7.0%, while vans were flat, according to Cox Automotive.

In another part of the wholesale market, Cox Automotive indicated the average price for rental risk units sold at auction during the first 15 days of May rose 3.7% year-over-year. And rental risk prices climbed 1.7% compared to the full month of April.

While those units might cost more to secure, Cox Automotive pointed the average mileage for those rental risk units in the first half of May came in at 58,500 miles, which was 7.9% lower compared to a year ago and 1.9% lower month over month.

Another segment of the Data Point delved into inventory levels at dealerships.

Using estimates based on vAuto data as of May 8, Cox Automotive said used retail days’ supply stood at 43 days, which was down one day from the end of April. Analysts determined days’ supply was eight days lower year-over-year and three days lower compared with the same week in 2019.

“Leveraging Manheim sales and inventory data, we estimate that wholesale supply ended April at 25 days, up two days from the end of March and down one day year over year,” analysts said. “As of May 15, wholesale supply was at 24 days, down one day from the end of April, down two days year over year, and flat compared to 2019.

“Used retail supply measured in days’ supply and compared to 2019 suggests supply is slightly below normal for this time of year, indicating some mismatch between demand and supply despite persistent but improving low inventory levels,” they added.

Cox Automotive closed out this Data Point with some information about tax refunds.

“While the 2023 tax refund season started faster than last year in terms of distribution of refunds, 2023 is behind 2022 on all key metrics,” analysts said.

With statistics through the week ending May 5, Cox Automotive said $263 billion in refunds have been issued, adding that the number of refunds issued is down 1% from last year.

Analysts added 8% less has been disbursed than last year, and the average refund at $2,803 is down 7% year-over-year.