Has the spring market already peaked?

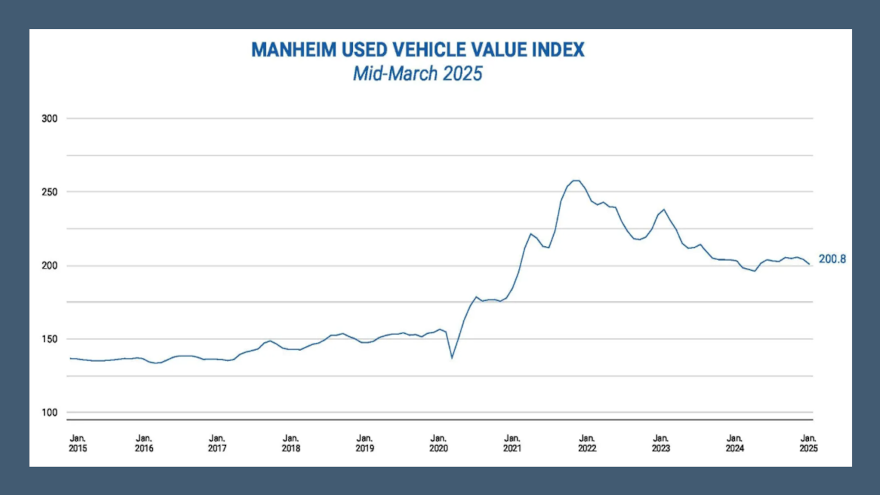

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The vernal equinox arrived on Thursday, but Cox Automotive suspects that the peak of the spring market might have arrived by the middle of March.

Analysts reported that wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) dropped from February during the first 15 days of March.

The mid-month Manheim Used Vehicle Value Index slid to 200.8, representing a decline of 1.1% from the full month of March 2024.

Cox Automotive noted the seasonal adjustment worked against the March non-adjusted price increase. Analysts determined the non-adjusted price change in the first half of March rose 1.7% compared to February, and the unadjusted price is down 0.5% year-over-year.

Analysts pointed out that the average move recorded in March is an increase of more than 3 points on non-adjusted values, indicating the appreciation observed so far in March is lower than typically seen.

“In the first half of March, we have seen exactly half of the rise in vehicle appreciation that we typically see for the full month,” said Jeremy Robb, senior director of economic and industry insights at Cox Automotive. “Prices are higher, but up less than expected, likely due to an older vehicle mix as lease maturities decline.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

While full March results are a few weeks away, we are now at the time when we typically see the strongest weekly gains for wholesale prices — our ‘Spring Bounce.’ Tax refund season is well underway, and consumers are getting more money in their pockets; used retail days’ supply is tight,” Robb continued in a news release. “But there’s no question that tariff talk is spooking some consumers, and we may have already seen the peak in the wholesale market.”

During the first two weeks of March, Cox Automotive indicated the Manheim Market Report (MMR) prices in the Three-Year-Old Index increased by an aggregate of 0.6%, which demonstrates weaker appreciation trends than have been seen over the same weeks in recent years.

And through the first 15 days of the month, analysts explained that MMR Retention — the average difference in price relative to current MMR — averaged 100.7%, indicating that market prices have moved a bit ahead of valuation models early in March.

Cox Automotive added MMR retention is eight-tenths of a point higher compared to the first half of last March.

Analysts went on to mention the average daily sales conversion rate of 66.6% during the first half of the month was 5 points higher than last year’s level of 61.5%, and it is above the first half of March 2019 by more than 1 point.

Looking deeper into the data, Cox Automotive said most major market segments saw negative results for seasonally adjusted prices year-over-year during the first half of March.

Compared to the industry’s year-over-year decrease of 1.1%, analysts noticed that luxury performed best, rising by 0.2%.

Cox Automotive noted that the 0.8% decline in SUVs was also less than the industry average.

All other segments declined more than the industry average, as pickup trucks fell 1.2%, mid-size cars were down 4.9%, and compact cars were down 6.6% during the first 15 days of March, according to Cox Automotive tracking.

Analysts also determined all segments were down compared with the results at the end of February. They said overall industry decreased by 1.6% compared to the prior month.

“The luxury segment declined just 0.5%, SUVs fell 0.9%, while pickup trucks and compact cars decreased 1.2% over the period. The mid-size sedan segment performed the worst, falling by 1.8% compared to the prior month,” Cox Automotive said.

In other parts of their data set, analysts said depreciation levels for electric vehicles have moderated recently.

Cox Automotive said EV values softened 4.9% compared to March of last year, while the non-EV segment was down 1.3%.

Analysts added EVs decreased by 4.0% in the first half of March compared to February values, while non-EVs were down only 0.8% in the month.

Leveraging Manheim sales and inventory data, Cox Automotive closed its update by noting wholesale supply ended February at an estimated 26 days, down one day from the end of January and up one day compared to February of last year when the reading stood at at 25 days.

“Wholesale supply continues to hold tighter at this time of year, running almost four days lower than the longer-term levels for this week,” analysts said. “As of March 15, wholesale supply had declined two days from the end of February, at 24 days, and was flat versus last year.”