Kontos looks at potential wholesale price trends using federal data

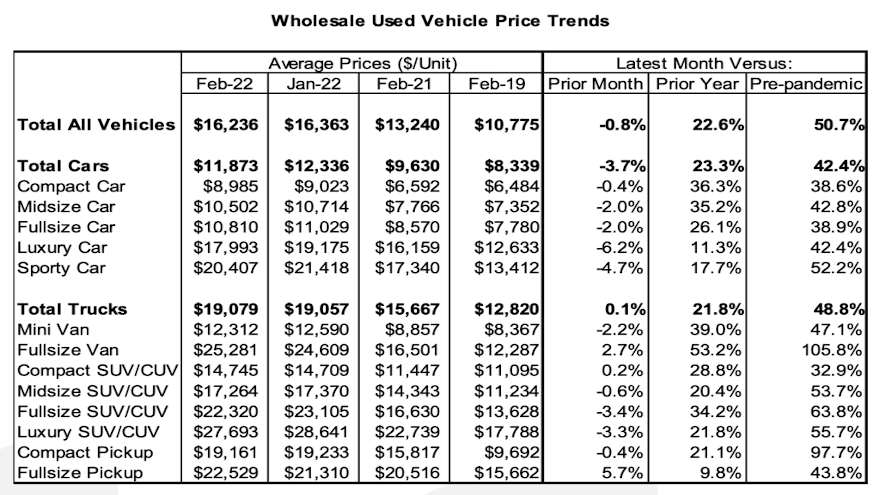

Chart courtesy of KAR Global.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Along with his usual review of wholesale price data compiled within KAR Global, chief economist Tom Kontos also used his regular industry update to offer a forward-looking price assessment, leveraging figures from the U.S. Bureau of Labor Statistics.

For his newest Kontos Kommentary, Kontos examined the historical relationship between the used- and new-vehicle consumer price indexes generated by the federal agency. He blended the data to create the ratio of the used vehicle CPI to the new vehicle CPI going back to January 1990.

Kontos discovered the ratio reading normally lands between 0.90 and 1.10, with an average of about 1.00.

“This makes sense since used-vehicle price increases are generally limited to the growth rate in new vehicle prices,” Kontos said in his report. “Ultimately, new-vehicle prices represent a ceiling on used-vehicle prices because new and used vehicles are substitute goods.

“However, since the pandemic, the ratio has jumped to over 1.20 and stood at 1.26 in February,” he continued. “This situation is likely the result of the chip shortage and other supply chain bottlenecks that have limited new-vehicle availability as a substitute for high-priced used vehicles.

“As supply normalizes, used-vehicle price growth should return closer to its typical one-to-one relationship with new. This price normalization will likely be gradual, as it will take some time for both new- and used-vehicle supply to recover,” Kontos went on to say in his analysis that also is available via an online video.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Turning back to the data the company generated, Kontos said that according to KAR Global Analytical Services’ monthly analysis of wholesale used vehicle prices by vehicle model class, wholesale prices in January averaged $16,363, which was up 2.1% compared to December and 30.4% higher relative to January 2021.

The reading also marked a whopping 52.1% spike compared to the pre-pandemic level recorded in January 2019.

Kontos determined that wholesale prices in February averaged $16,236, softening 0.8% compared to January, but rising 22.6% year-over-year.

And compared to February 2019 and just before the pandemic, that February figure represented a 50.7% jump.

“Average wholesale prices have held fairly steady at the start of 2022, though they have softened modestly from peak levels achieved in early November 2021 and to date have not shown their typical spring/tax season uptick,” Kontos said.

“A key difference in current market conditions versus those in place during the November price peak is that rental companies have started to receive a greater allocation of new vehicles, which has diminished their need to purchase late-model used vehicles as a substitute,” he continued.

“Retail used-vehicle sales and CPO sales have started the year down compared to 2021, 2020 and 2019, as consumers may be shying away from purchasing used vehicles at such historically high prices,” Kontos went on to say.