Lane watch: 4 ingredients form current state of wholesale market

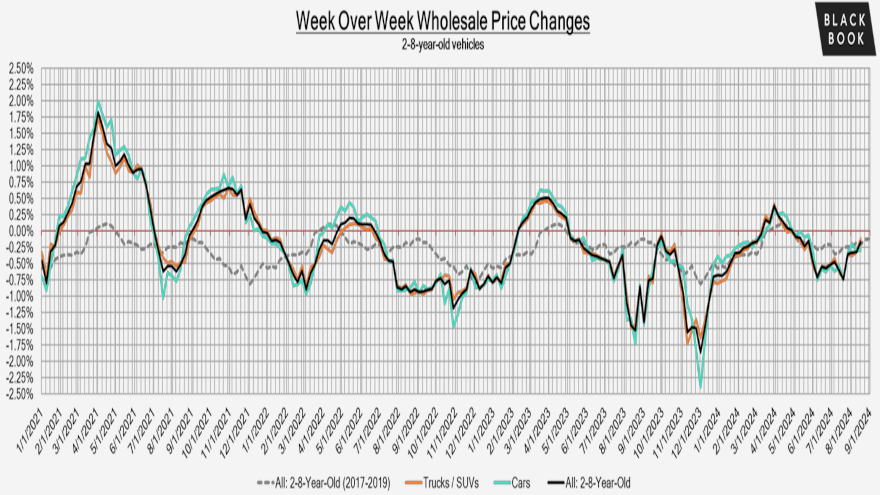

Chart courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Perhaps dealers are mingling in the auction lanes or holding their smartphones scouring the wholesale market and asking, “How did we get here?”

Well, Black Book offered an answer on Tuesday after analysts spotted a 0.17% dip in wholesale values last week.

“Fast forward three years from a COVID market low in new-vehicle production,” Black Book began in its latest installment of Market Insights. “Add high interest rates, significant negative equity and rising new-vehicle incentives and you get a mix of adjustments in the wholesale market.

“Last week, segments like compact cars, crossovers, minivans and small pickups performed well, while high-dollar segments like the full-size luxury crossover/SUV experienced significant declines,” analysts continued in the report.

Black Book indicated the full-size luxury crossover/SUV segment posted the largest price decline last week, falling by 0.80%, marking its 16th consecutive week of decreases.

Analysts pointed out the non-luxury full-size crossover/SUV segment is also declining but at a slower rate. Black Book said prices for those units dropped 0.07% last week compared to a decrease of 1.41% a month ago.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

All told, overall truck values on a volume-weighted basis dipped by just 0.12% with three segments generating a price uptick, according to Black Book.

Analysts noticed the small pickup segment posted its first value increase since early May last week. Black Book said prices for small pickups less than 2 years old rose by 0.32% and the 2- to 8-year-old models climbed by 0.29%. Meanwhile, Black Book noted the 8- to 16-year-old units continued to decline, albeit minimally, with a decrease of 0.08%.

On a volume-weighted basis, Black Book determined overall car segment values decreased 0.29%. But analysts found some interesting increases when looking deeper into that data.

Values for compact cars less than 2 years old rose another 0.59% last week, coming off an increase of 0.41% a week earlier.

And midsize cars less than 2 years old generated a price increase for the fourth week in a row, with Black Book putting the latest value climb at 0.76%.

Two other overall trends to mention were Black Book’s estimate of used retail days to turn remained at roughly 48 days, while last week’s auction conversion rate ticked up 1% to 59%,

“In the first half of August, depreciation has notably slowed down,” Black Book said. “Some segments experienced positive movement last week, with one car segment and three truck segments turning positive.

“Although the overall trend remains in decline, the rate has decreased significantly,” analysts continued. “This shift could indicate a potential market turn or could be a temporary anomaly.

“Additionally, auction inventory has leveled off and remained stable last week, further suggesting a possible stabilization or improvement in the market,” Black Book added. “As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight.”