Lane watch: 4 segments generate weekly value gains above 2%

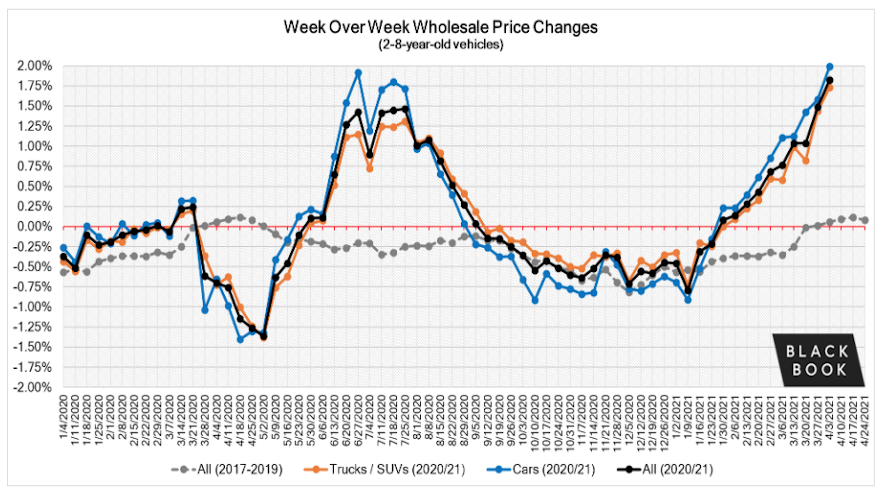

Chart courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

LAWRENCEVILLE, Ga. –

At this pace, dealerships are going to see their used-vehicle retail margins pinched tighter than when a salvage unit goes into the crusher.

Not only did values for every vehicle segment included in Black Book’s Market Insights increase by more than 1% in a single week, but four categories also generated gains greater than 2%.

Overall, analysts said wholesale prices jumped 1.82% last week with cars soaring 1.99% and trucks spiking 1.73%.

And how about these stats for some perspective? According to the report, the average gain during the same week during 2017 through 2019 came in at just 0.21% for cars.

The average truck movement? Well, values actually softened 0.06% during that timeframe.

“Wholesale supply continues to be tight, and it doesn’t sound like it is going to get better anytime soon,” Black Book said in the report. “Even as prices continue to rise, sales rates remain incredibly strong due to the lack of new and used inventory and strong retail demand.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Delays in new-inventory deliveries are forcing fleet and rental companies to keep units in service longer, further depleting the availability of used inventory in the market,” analysts continued.

“Consignors are reporting that they have slowed their rate of increases in floor pricing. But despite this, their transaction prices continue to rise each week,” Black Book went on to say.

Two of the four vehicle segments posting those value gains above 2% probably shouldn’t surprise used-car managers. Those tax season specials made even more appealing by additional federal stimulus money pushed values for compact cars up by 2.45% and for midsize cars by 2.62%.

Analysts pointed out that even premium sporty cars are getting into the upward value march, as prices in that segment went from a 0.32% to a jolt of 1.48% this past week.

In the truck domain, values of vehicles often utilized by families led the upward price charge with sub-compact crossovers rising 2.64% and minivans increasing 2.46%.

Popular full-size trucks nearly crossed the 2% value rise threshold, too, as analysts pegged their gain at 1.91%.

“As supply chain disruptions force OEMs to prioritize production of their profit leading models, the compact van (up 1.78%) and full-size van (up 1.06%) segments have been left with little supply in the market, further fueling the growth in values of these niche segments,” analysts said.