Lane watch: All 22 vehicle segments rise in value for first time since November 2021

Chart courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

There might be several used-car managers or buyers for a dealership or group who began a sentence recently with some salty language followed by, “This feels like 2021.”

Black Book reported all 22 vehicle segments that analysts monitor in the wholesale market increased in value last week. It’s the first time that’s happened since November 2021.

That situation propelled overall wholesale prices to rise 0.63% last week, according to the newest installment of Market Insights released by Black Book on Tuesday.

“The rise in the wholesale market and heightened activity in the lanes resemble conditions from four years ago, when the industry faced challenges related to new-vehicle inventory availability,” analysts said in the report.

Black Book reported car values jumped by 0.72% and the truck prices moved 0.60% higher last week. That’s the highest increase for the respective segments so far this year.

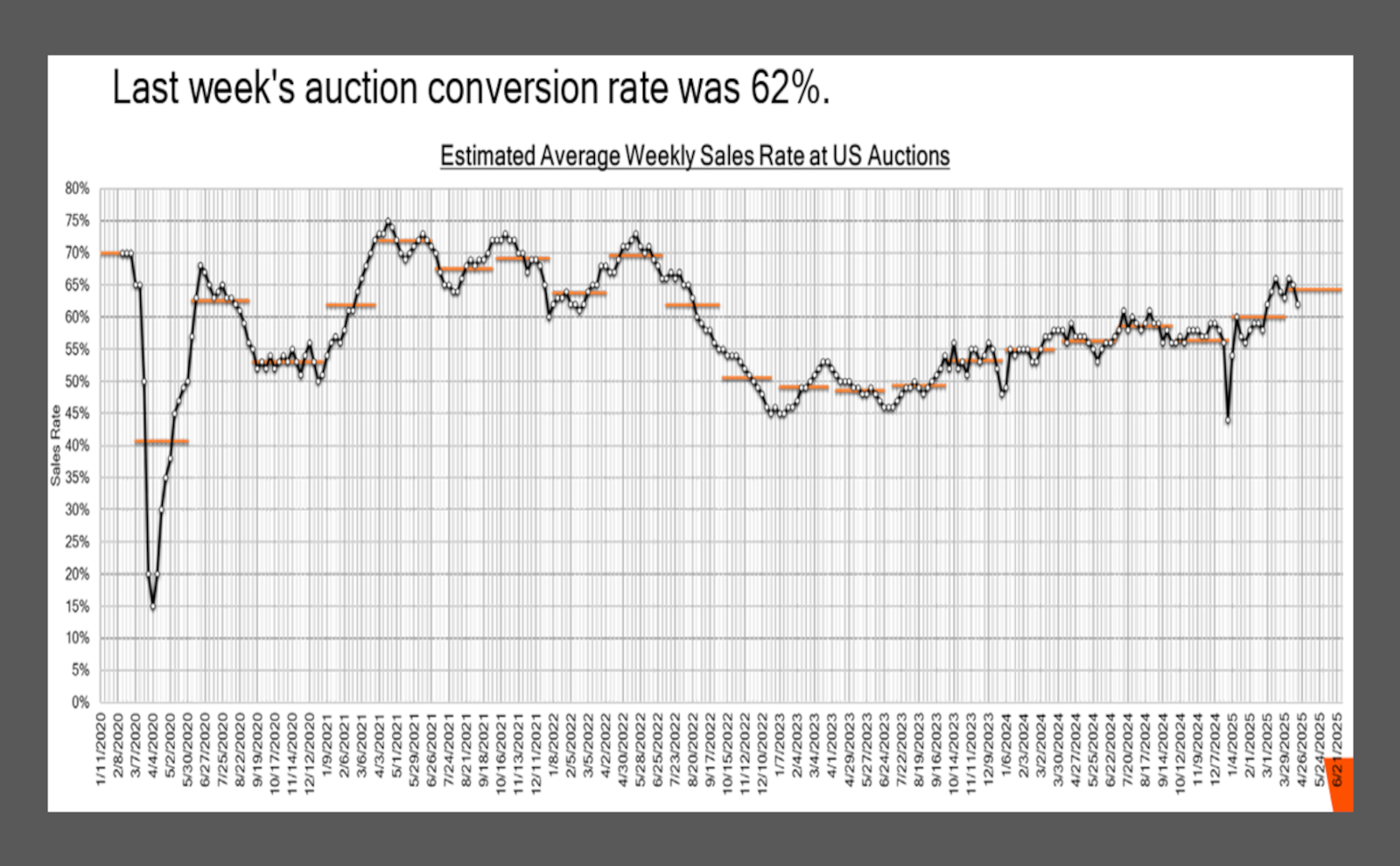

And buyers are raising their hands and clicking buttons since analysts determined last week’s auction conversion rate came in at 62%.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“The auction conversion rate continues to hold strong despite a 3% decline last week and a slight increase in overall auction inventory,” Black Book said. “Over the past eight weeks, conversion rates have consistently ranged between 62% and 66%.

“This sustained performance reflects a resilient market, as demand remains solid amidst fluctuating conditions,” analysts added.

Black Book also touched on the retail side of things in Market Insights. Analysts said the estimated used retail days to turn is now at roughly 39 days, which is the lowest point so far in 2025.

Black Book saw this retail trend sink to this level for a couple of weeks in April of last year. It did not drop below 42 days at all in 2023, rising to as high as 53 days during the summer of that year.

Summer of this year remains a few weeks away from officially arriving, but prices for some specific segments certainly are getting hot.

Black Book watched values for midsize cars spike 1.22%, marking the first time prices for those units increased by more than 1% in a single week since October 2021.

“Deviating from typical trends,” analysts noted that prices for prestige luxury cars rose 0.47% last week, representing the largest single-week increase for the segment since April 2022.

And perhaps with potential buyers looking for versatility, Black Book pointed out that the two truck segments with the greatest price increases last week included compact crossovers (up 0.99%) and sub-compact crossovers between 2 and 8 years old (up 1.02%).

While the auction scene continues to mimic 2021, Black Book reiterated, “As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight.”