Lane watch: Assessment remains ongoing of vehicle damage created by hurricanes

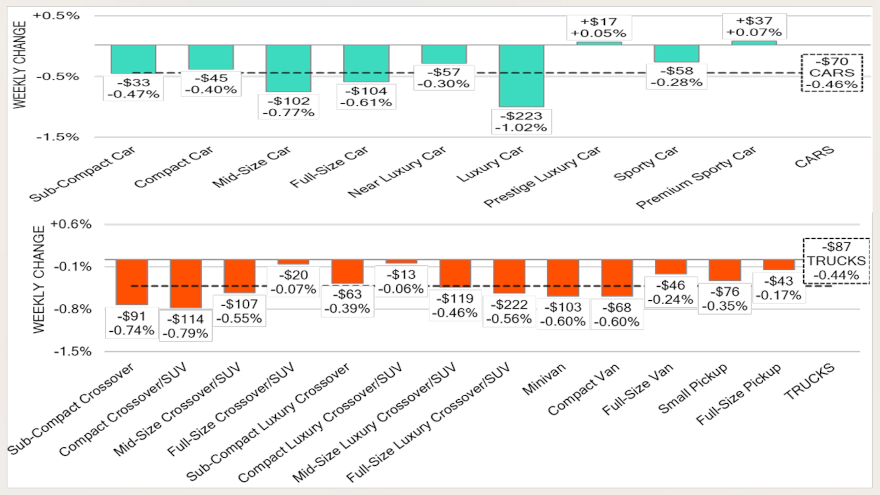

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Wholesale prices are falling, used cars are staying in dealer inventory longer and the entire industry is still gathering information about total damage created by two vicious hurricanes to strike in the past month.

That’s the main assertions included in Black Book’s newest Market Insights released on Tuesday, as the analysis covered the week that included Hurricane Milton scraping across Florida.

“Last week, auction activity slowed down in several locations across the Southeast, as the region focused on recovery efforts from Hurricane Helene, while Florida prepared for Hurricane Milton’s impact. Effects on the automotive industry remain unclear; however, the estimated number of affected vehicles continues to climb,” analysts said in the newest report, which said that overall wholesale prices dropped 0.44%.

While some sales might not have happened because of the storm, Black Book noticed last week’s auction conversion rate still came in at 57%, which was up 1%.

Perhaps retail sales eventually will pick up, especially in the Southeast, where consumers will need to replace a vehicle. But for now, Black Book said the estimated used retail days to turn industry wide is now roughly 53 days.

“Hurricane Milton’s landfall in central Florida has caused significant disruptions in auction operations across the Southeastern region,” analysts said. “These disruptions are likely to affect vehicle availability and pricing due to damage caused by the hurricane.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Auction houses and buyers are advised to carefully evaluate the condition of vehicles affected by the storm and modify their purchasing and selling strategies in response to the possible changes in inventory and prices,” Black Book continued. “Understanding the extent of the damage will be critical in managing expectations and operational plans considering the storm’s impact.”

Consignors and dealers will be making those plans amid a streak of four consecutive weeks of value declines for both cars and trucks.

Black Book said seven of the nine car segments posted price decreases last week, with only the premium sporty and prestige luxury car segments generating modest value gains of 0.07% and 0.05%, respectively.

Even a specific car segment — compact cars less than 2 years old — sustained a price decline. Black Book noticed values for those particular units dipped 0.05% after 10 consecutive weeks of price increases.

Values for older compact cars dropped, too. Black Book spotted a 0.40% price decline for 8- to 16-year-old compact cars last week after values for those vehicles climbed eight weeks in a row.

In the truck department, all 13 truck segments posted price decreases last week, according to Black Book tracking.

The compact crossover segment led the way with a value decline of 0.79%

Analysts noted that prices for small pickups decreased again, too, falling another 0.35% last week after a drop of 0.49% a week earlier. Those movements surfaced after Black Book said prices for small pickups climbed seven straight weeks.

With flood-damaged vehicles likely to bubble up throughout the wholesale market, Black Book reiterated “as always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight.”