Lane watch: Auction action might have sprung forward, too

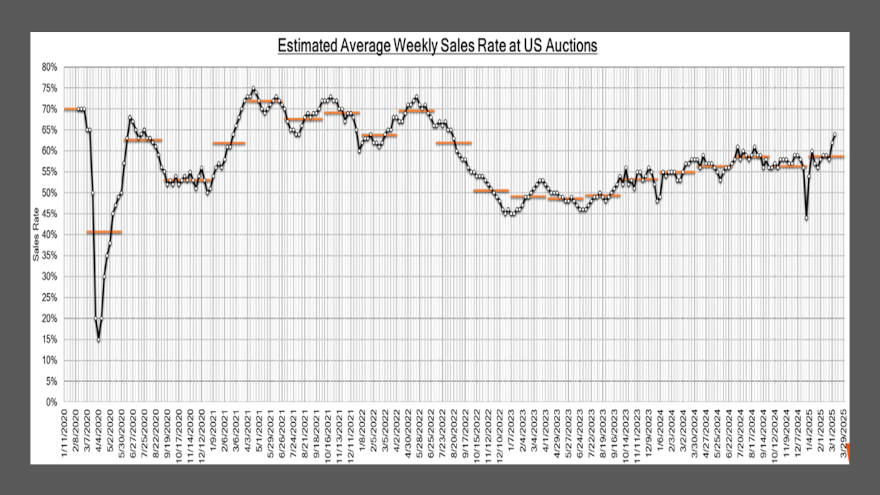

Chart courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Most Americans sprung forward on Sunday, turning their clocks ahead an hour as spring gets officially closer.

Meanwhile, current wholesale market conditions are showing the arrival time of the spring market might already be here.

Black Book reported on Tuesday that overall wholesale prices ticked up 0.03%, with the auction conversion rate rising again to 64%.

That conversion rate set a new high for the year, surpassing the mark of 62% established just two weeks ago, according to Black Book tracking.

“Last week was eventful, with daily updates on tariffs creating uncertainty,” Black Book said in its latest installment of Market Insights. “Auctions saw strong bidding activity nationwide, marked by high sales rates and growing demand, especially for late-model units, as many speculated tariffs would raise new vehicle prices, boosting used-car demand. The industry gained another month’s reprieve from tariffs.

“Meanwhile, consumer refund checks are hitting bank accounts, adding another factor to monitor for its impact on used-car values,” analysts added in the report.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

While the auction scene might be intensifying, Black Book indicated the estimated used retail days-to-turn is now at roughly 45 days.

So, what are dealers thinking might retail best on their lots nowadays? Let’s consider what’s increasing in price in the wholesale market triggered by potential demand.

Black Book reported that full-size cars less than 2 years old appreciated by 0.47% last week. However, there’s a caveat to that movement.

“This segment remains small, with limited competition, as many manufacturers have withdrawn from the sedan market in recent years,” analysts said.

Perhaps more relevant to more dealerships, Black Book determined prices for eight out of the 13 truck segments increased last week, marking the first time since the middle of September that happened.

Values for full-size trucks rose another 0.20%, representing an increase for the second week in a row within Black Book’s data.

Which segments might be still in hibernation as far as wholesale prices go?

Black Book pointed out that minivans continue to decline, as their value dropped 0.45% last week. Over the past eight weeks, analysts said prices for those people movers have averaged a weekly decline of 0.60%.

Another place where analysts are seeing price softening is connected with 8- to 16-year-old cars, which decreased by 0.46%.

Now with daylight often lasting until suppertime for many people, Black Book is engaged with what’s going to happen next in the lanes.

“Over the past two weeks, there has been a noticeable shift in momentum, with more positive movements emerging as we move further into 2025,” Black Book said.

“As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight,” Black Book went on to say.