Lane watch: Current trends ‘aren’t one size fits all’

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Black Book’s latest installment of Market Insights approached both wholesale and retail perspectives since dealers are amid holiday weekend sales campaigns and looking to close May on a positive note.

During the week that closed two days before Memorial Day, Black Book watched wholesale values soften another 0.15%, which was 9 basis points less than a week earlier.

Analysts also noted the average auction sales rate dropped 1% to 55%.

“The market continues to report ‘normalcy’ with the overall declines on-pace with pre-pandemic behavior,” Black Book said in its report released on Tuesday. “However, the trends aren’t one size fits all, with the trends of auction inventory and conversion rates varying from lane to lane, depending on the seller’s strategy and offered inventory.”

And how is that spilling into the retail side of things, especially since dealers likely are trying to use holiday weekend excitement to meet monthly sales goals by the close of business on Friday?

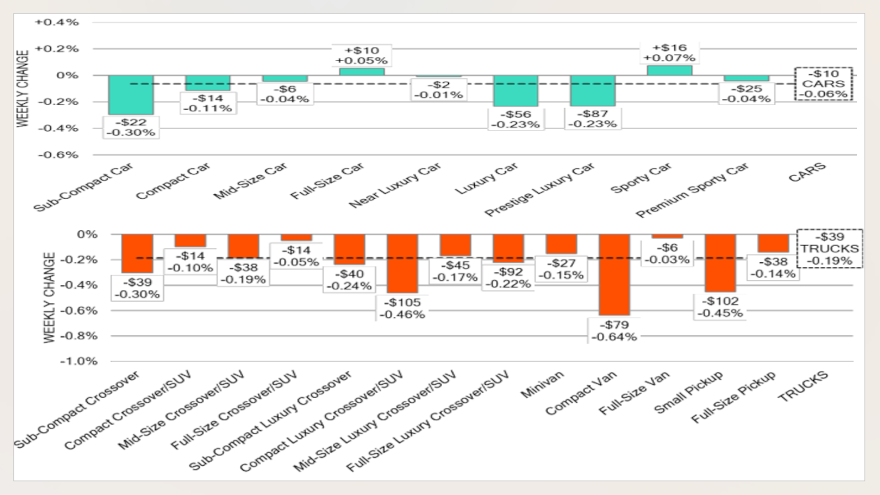

“While overall prices are trending downward, it’s interesting to note that full-size and sporty cars are experiencing price increases, which could be due to a variety of reasons such as consumer preferences, seasonal demand, or supply constraints,” Black Book said.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“On the other hand, all truck segments are seeing decreasing prices, which could make them more attractive to potential buyers looking for deals during the holiday,” analysts continued. “These trends can be valuable information for dealerships, fleet buyers, and individual consumers alike, as they can inform purchasing decisions and inventory management leading up to the holiday weekend, which is often associated with sales and promotions in the automotive industry.”

As mentioned, Black Book pointed out prices for full-size cars have increased during 13 of the past 14 weeks, posting an average weekly uptick of 0.15% during that stretch. But full-size cars edged up only 0.05% last week.

And regarding sporty cars, analysts said values for those rides have climbed for nine weeks in a row with the streak continuing thanks to a 0.07% uptick a week ago.

One other note about cars, Black Book noticed prices for cars 8 to 16 years old dropped 0.10% last week.

Turning to trucks, all 13 segments sustained value declines last week, with analysts computing the overall decrease to be 0.19% on a volume-weighted basis.

Pacing those declines were compact vans, which depreciated by 0.64% last week after sliding 0.62% a week earlier.

And no matter the truck’s age, Black Book noticed similar value decreases, as models up to 2 years old dropped 0.22% on average, while 8- to 16-year-old units decreased by 0.20% on average.

With June straight ahead, Black Book reiterated, “as always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight.”