Lane watch: Despite slightly softer increase to close May, Black Book index at new record

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

LAWRENCEVILLE, Ga. –

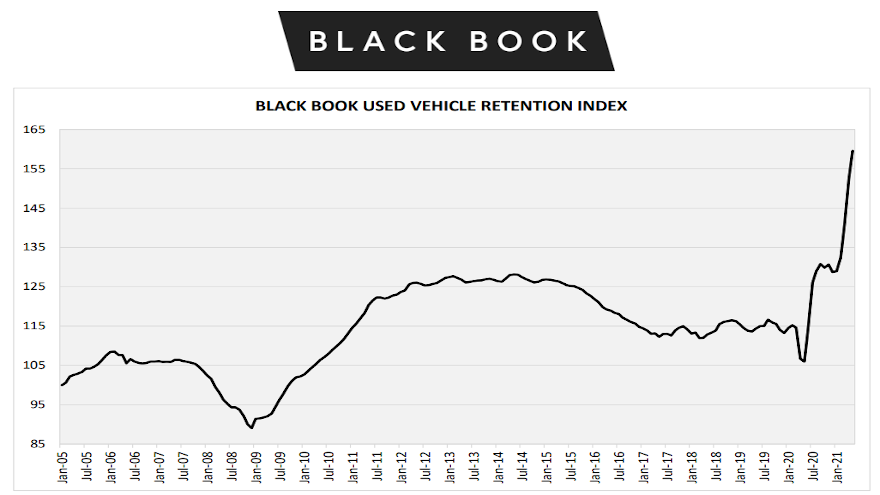

While slightly softer than the previous weeks in the month, Black Book highlighted another weekly wholesale value uptick — extending the industry’s streak to 18 in a row — lifted its Used Vehicle Retention Index to another record.

Black Book reported its May index reading came in at 159.6, increasing 7.1 points or 4.7% from the previous record set in at April at 152.4.

Black Book senior vice president of data science and analytics Alex Yurchenko indicated that the index currently stands 50.6% above where it was the same time last year. Yurchenko pointed out that juncture marked the lowest point in automotive values due to COVID-19.

“Wholesale prices continued their ascent each week in April, although the rate of increase declined through the month,” Yurchenko said in a news release. “Demand for used and new vehicles remained strong even with dwindling new inventory. Available used inventory stabilized in April and started to build up at the end of the month, although we are still about 10% below where we started the year.

“This strong demand and still low inventory together with low (and declining) incentive levels on new vehicles helped the retention index to increase for the fifth month in the row, to a new record,” he went on to say. “This month, all segments besides full-size vans showed increases, with minivans having the largest gains again (almost 13%).”

The Black Book Used Vehicle Retention Index — which can be downloaded on this website — is calculated using Black Book’s published wholesale average value on 2- to 6-year-old used vehicles, as a percent of original typically equipped MSRP. It is weighted based on registration volume and adjusted for seasonality, vehicle age, mileage, and condition.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

In its weekly Market Insights report, Black Book recapped what Yurchenko referenced. Wholesale prices closed May with another weekly gain but not quite as strong as what analysts have seen during this runup in prices.

On a volume-weighted basis, Black Book reported overall car segment values rose another 0.9% last week, down a bit from the previous week’s rise of 1.17%.

Analysts noted that the sub-compact and compact cars segments posted the largest weekly gains at 1.55% and 1.2%, respectively, as all nine car segments moved higher.

In fact, Black Book pointed out that compact cars have had higher value increases than the overall car segment average for 11 consecutive weeks.

On a volume-weighted basis in the truck world, overall segment values also rose by 0.9% last week, nearly mimicking the previous week’s increase of 0.93%.

All 13 truck segments generated price increases last week, with five exceeding 1%. Leading the truck pace were mid-size luxury crossover/SUVs and compact luxury crossover/SUVs with weekly value gains of 1.37% and 1.25%, respectively.

Those two truck segments now have risen for six and five weeks in a row, respectively, according to the latest report.

Black Book also alluded to a point Yurchenko made in his assessment of the latest index reading.

“Current used retail listing volume is about 11% below the start of the year, but the inventory levels have slowly but consistently increased over the last six weeks, which indicates that dealers are able to procure inventory,” Black Book said.