Lane watch: Largest single-week value decline since January

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Black Book spotted the largest single-week value decline since the middle of January during the stretch that included Memorial Day and the end of May.

As depreciation accelerated, analysts also noticed the average auction sales rate last week dropped 2% from the previous week to land at 53%.

“These market dynamics are intriguing, particularly when considering the timing of events such as Memorial Day and the end of the month, which often impact purchasing patterns,” Black Book said in its latest installment of Market Insights released on Tuesday.

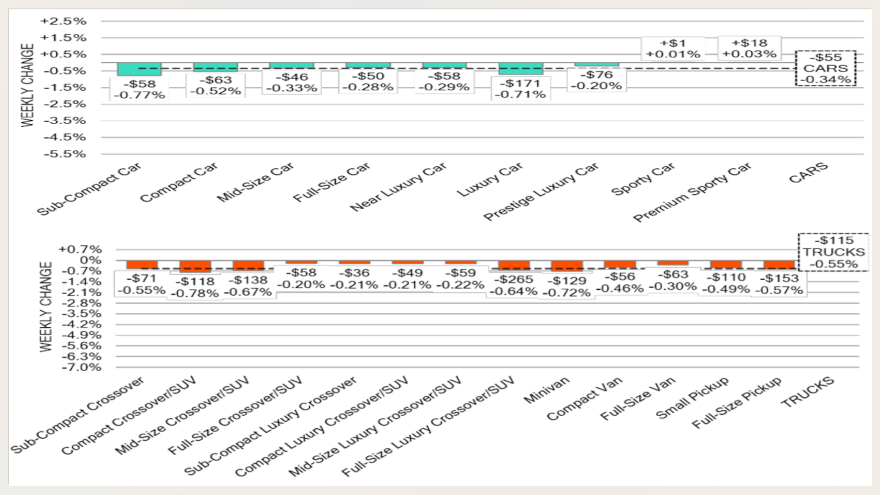

On a volume-weighted basis, Black Book said overall car prices retreated 0.34% last week, marking quite a jump from the previous week’s decrease of just 0.06%.

Likely reflecting demand for summertime rides, analysts said values for sporty cars and premium sporty cars were the only segments to rise last week. In fact, Black Book said prices for sporty cars now have increased for 10 consecutive weeks with an average weekly gain of 0.26%.

Moving in the opposite direction are subcompact cars, which posted the largest decline last week. Black Book said prices for those fuel-sippers dropped 0.77%, compared with a 0.30% price dip during the prior week.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

According to Black Book, prices for subcompact cars have been declining for eight consecutive weeks, with an average weekly drop of 0.41%.

Black Book turned to trucks next, noting its volume-weighted data revealed an overall truck segment decrease of 0.55%.

Analysts noticed the truck decline surfaced no matter the unit’s age, as 0- to 2-year-old models declined 0.37% on average, while 8- to 16-year-old units decreased by 0.33% on average.

Black Book said all 13 truck segments posted value declines last week, paced by compact crossovers, which depreciated by 0.78%.

Analysts indicated compact crossovers have been declining in value for six weeks, but this was the largest single week drop for the segment since the second week of January.

Another truck segment that hadn’t softened in value since that point in the opening month of the year was the full-size pickup segment, as Black Book said those units dropped by 0.57%.

As the industry steams deeper into summertime, Black Book reiterated, “as always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight.”