Lane watch: Market shifts again with Labor Day approaching

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Well, you can say this about the wholesale market. It’s usually not boring for active buyers, sellers and observers.

With children back in school and football season set to begin in earnest, Black Book spotted more intriguing trends on Tuesday to keep consignors and dealers educated so they can celebrate in the retail end zone.

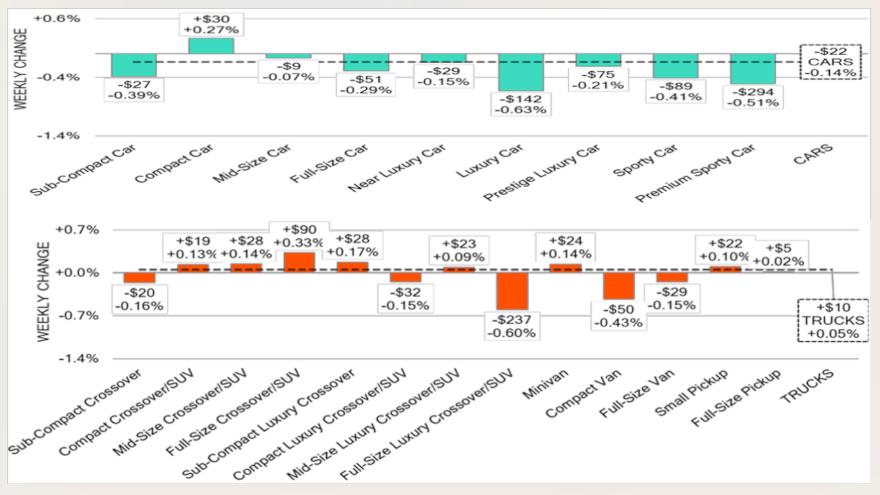

“As we approach the last week of August and the Labor Day holiday, the market shifted with the overall truck market seeing an increase in values last week and car depreciation slowing to a typical seasonal decline for this time of year,” analysts said in the newest installment of Market Insights.

Those truck prices ticked up 0.05% while overall market values remained flat, according to Black Book tracking, which also highlighted improvements for moving vehicles in both the wholesale and retail worlds.

Black Book said its estimated used retail days to turn is now at roughly 44 days; only a couple of weeks after it was about 50 days. Analysts also noticed the auction conversion rate last week came in at 61%, an increase of 2% from the previous week.

“The truck market showed significant improvement last week, with over half of its segments experiencing positive gains,” Black Book said in the report. “The car market, however, faced challenges, with only one segment recording an increase.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Despite these struggles, the slowing depreciation in the car market points towards potential stabilization. Additionally, the auction conversion rate increased while inventory levels decreased during the same period,” Black Book continued.

On a volume-weighted basis, Black Book reported overall car segment dropped by 0.14% with prices for luxury cars leading the decreases at 0.63%. Analysts said prices for luxury cars have averaged a weekly decline of 0.62% during the past six weeks.

While those highline rides are depreciating, there are specific segments of cars that are fetching higher prices at auction.

That contingent includes compact cars (up 0.27%). In fact, values for compact cars less than 2 years old have climbed for four consecutive weeks after a gain of 0.32% last week.

Dealers appear to be on the hunt for late-model cars in general since Black Book noticed prices within four out of the nine car segments aged less than 2 years old posted an increase a week ago.

Looking closer at the truck market, Black Book spotted an interesting divergent involving full-size crossovers/SUVs.

Analysts reported prices for the luxury version of those vehicles dropped another 0.60% last week. But the non-luxury versions generated a 0.33% value gain, marking the first increase in the segment since May.

Black Book added prices for minivans less than 2 years old now have climbed for six of the last seven weeks thanks to a 0.25% increase a week ago.

While some of us will be in the stands or near televisions cheering for our favorite football teams, Black Book said, “As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight.”