Lane watch: Multiple vehicle segments make price moves not seen since 2021

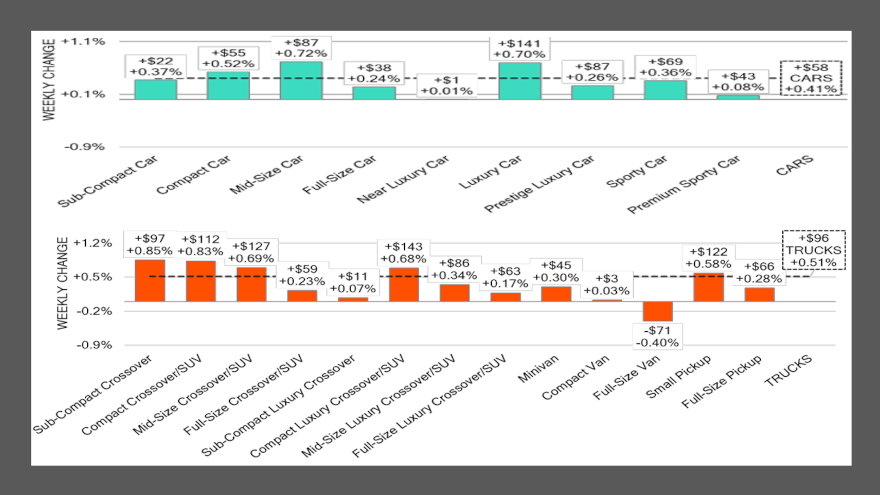

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

In a couple of specific cases, it’s been nearly four years since Black Book has seen wholesale prices for certain vehicles rise in price this much in a single week.

And dealers and consignors likely don’t need too many guesses to pinpoint why it happened during the week that closed three days before individuals had to get their federal and state taxes filed.

“The announcement of tariff implementation spurred increased activity at the auctions,” Black Book said in its latest installment of Market Insights released on Tuesday.

“Although some tariffs were later reduced, those affecting the automotive industry remained in place. This prompted buyers to flock to auctions, aiming to secure inventory in anticipation of reduced new vehicle availability driving higher demand for used vehicles,” analysts continued in the report.

Black Book reported last week’s auction conversion rate came in at 65%. If dealers wanted inventory that might appeal to potential buyers who already are weary of making a vehicle purchase, managers had to reach deeper into their floorplans if they wanted late-model compact cars or mid-size crossovers/SUVs.

According to Black Book, values for compact cars up to 2 years old spiked by 1.11% last week, marking the largest gain for those units since November 2021.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Analysts added that prices for compact cars between 2 and 8 years old rose by 0.52%, while values for compact cars up to 16 years old ticked up by 0.23%.

When looking at mid-size crossovers/SUVs, Black Book noticed values for units up to 2 years old rose by 0.77%, while prices for those units between 2 and 8 years old increased by 0.69%. Analysts said these rises represent the largest single-week increases for these segments since June 2021.

All told, Black Book determined that all nine car segments experienced value increases last week, while prices for 12 out of the 13 truck segments rose a week ago.

Analysts pointed out that it’s been two years since all nine car segments moved higher in value during the same week.

“Last week showcased a strong performance in the wholesale market, achieving a significant milestone for the year. For the first time, nearly all segments saw positive increases, with full-size vans being the sole segment to report a decline,” Black Book said.

An update on two ongoing trends: Canadian vehicles exporting to the U.S. — the number of ‘previous Canada’ vehicles appearing in auctions has dropped to nearly half of what we observed just 30 days ago. However, prices for these vehicles continue to rise as inventory declines. Additionally, a substantial volume of vehicles are still being offered for sale in the OEM lanes,” analysts continued.

“As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight,” Black Book went on to say.