Lane watch: Push to turn new 2024 models impacting auction activity

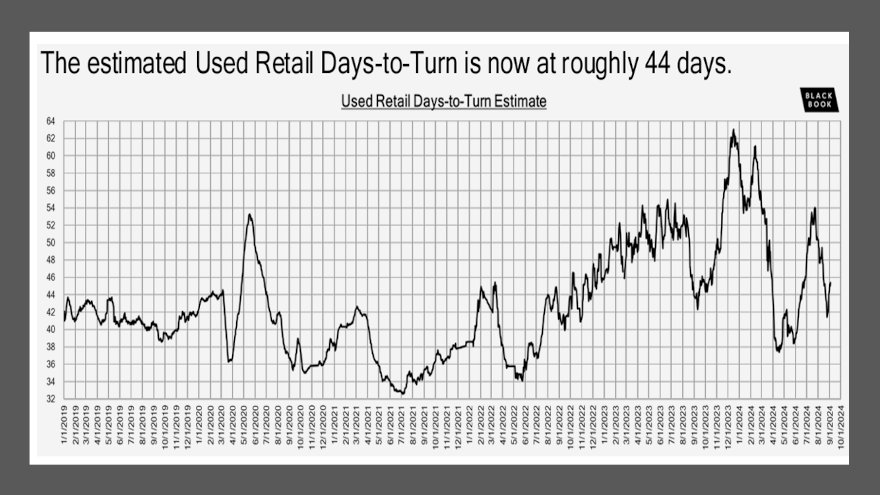

Chart courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The potential tug of war between the new-car and used-car departments might be surfacing not only in the showroom, but also the auction lane, too.

Black Book described the current situation in its newest installment of Market Insights distributed on Tuesday.

“There is a noted trend of an increasing presence of 2024 model-year vehicles in auction lanes,” analysts said in the report. “These vehicles are experiencing price declines, mainly due to the availability of new 2024 inventory at dealerships.

“The dealerships are selling these newer models with various incentives like dealer discounts, OEM rebates and other promotions, leading to lower auction prices for the same models,” Black Book continued.

Overall, Black Book said wholesale prices edged up 0.03%, while the auction conversion rate remained at 59%.

And perhaps with new-model salespeople getting more traction, Black Book added the estimated used retail days to turn ticked up again and is now at roughly 44 days.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“The market continues to deviate from seasonal norms, with another week of increasing wholesale values,” analysts said, noting that 10 of the 23 vehicle segments tracked by Black Book generating value increases last week.

“Meanwhile, a majority of the luxury segments continue to decline,” Black Book continued.

“In the first week of September, the car segment continued to show a decline, mirroring the end of August,” analysts went on to say. “Conversely, the truck segment displayed positive movement across several of its sub-segments. This trend highlights a persistent downturn in the car market while the truck market gains traction.”

Looking deeper into the car data that Black Book compiled on a volume-weighted basis, analysts noticed value increases within six of nine car segments when looking only at units less than 2 years old.

Most notable within that specific bracket were compact cars less than 2 years old. Black Book said prices for those vehicles now have increased for six weeks in a row, with the latest rise being 0.28%.

Values for full-size cars less than 2 years old also moved higher for the third consecutive week, increasing by 0.16% last week, according to Black Book tracking.

In the truck department, Black Book said small pickups continued to rise in value, edging up for four weeks in a row. But that streak remained by a slim margin with analysts pegging the uptick at just 0.01%. A week earlier, Black Book noted prices for small pickups jumped 0.59%.

Also, of note among the 13 truck segments, Black Book noticed prices for 2- to 8-year-old minivans rose another 0.08% last week, marking an increase in eight of the past nine weeks for the specific segment.

While Black Book likely doesn’t want a clash between dealership departments to get too heated, “as always, our team of analysts are focused on keeping their eyes on the market for developing trends and gathering insight.”