Lane watch: Seasonal softening finally surfaces

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

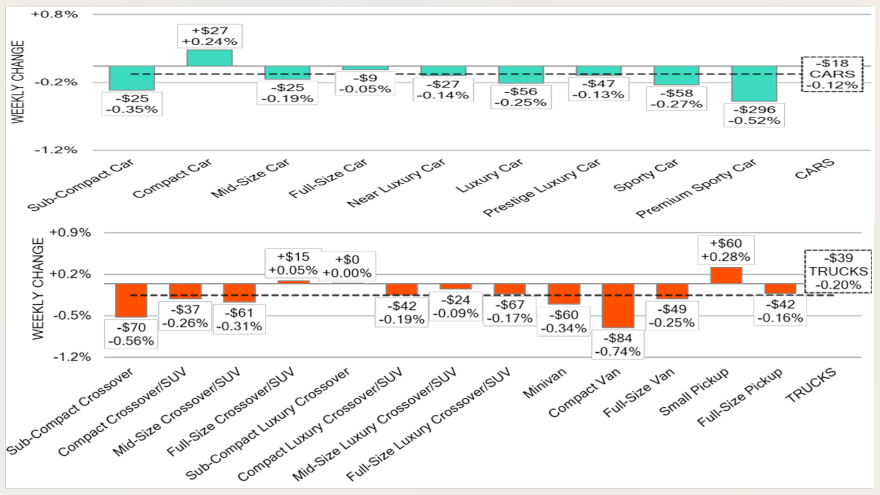

While some specific vehicle segments continue to gain value, Black Book spotted wholesale price declines often seen this time of year.

Analysts said, “the market shifted towards typical seasonal expectations,” when wholesale values softened by 0.17% a week ago.

Black Book continued in its newest installment of Market Insights that, “Despite last week’s drop, the rate of decline remains smaller than usual for this time of year, as pre-COVID, this same week averaged a drop of roughly a quarter percent in valuations.”

Earlier in August and September, Black Book noticed wholesale prices edging up slightly during a time — especially before the pandemic — that values often would decrease by 0.20% or more each week.

And along with the double-digit decrease recorded last week, analysts said the auction conversion rate rose 2% to come in at 58%.

Another trend Black Book revisited is how values are dipping for 2024 models coming into the wholesale market.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“A notable trend is the depreciation of 2024 used vehicle values in auction lanes, driven by the substantial inventory of new 2024 vehicles still available on dealer lots, often accompanied by rebates and incentives,” analysts said in the report. “Consequently, used 2024 vehicle values are declining, with some approaching the values of 2023 models.”

Perhaps reflecting fall’s official arrival on Monday, Black Book mentioned prices for premium sporty cars dropped 0.52%.

Analysts also noted values for compact vans sustained the largest decline last week, dropping by 0.74%. Black Book said the segment has been on a downward trend for 24 weeks, with an average weekly decline of 0.52%.

However, there are pockets of specific vehicles where wholesale prices are increasing.

For example, Black Book reported values for cars up to 2 years old rose 0.11% last week. Compact cars in that age range generated a price rise of 0.93%.

And looking even closer at compact cars, analysts determined that prices for units 2- to 8-years-old rose another 0.24%, representing the fifth increase in the past six weeks.

Meanwhile, Black Book pointed out the small pickup segment also continued its upward path of price increases, gaining another 0.28% last week and marking the sixth consecutive week of appreciation.

What do all the wholesale price trends mean for dealerships’ sales efforts? Black Book said its estimated used retail days to turn made a notable retreat, now sitting at roughly 42 days.

“As always, our team of analysts are focused on keeping their eyes on the market for developing trends and gathering insight,” Black Book said.