Lane watch: ‘Stability’ and ‘normalcy’ remain in wholesale market

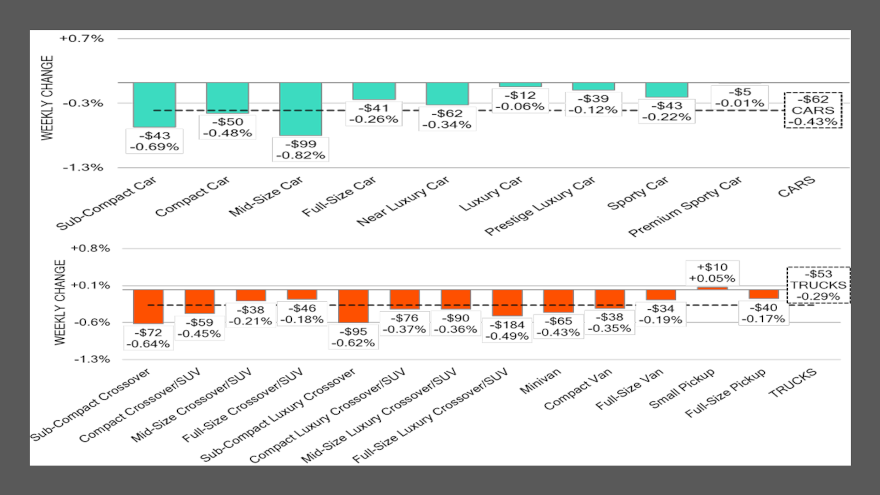

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

If you’re looking for automotive gossip, the wholesale market likely isn’t the place for it at this juncture.

Overall prices softened by 0.33% last week, according to the newest Market Insights from Black Book.

That value movement is within 4 basis points of a week earlier and the average spotted during the same week in 2017 through 2019.

Analysts said, “The market is currently characterized by ‘stability’ and ‘normalcy,’ even amid various headline-grabbing external factors. Despite these influences, the wholesale market consistently reports typical seasonal depreciation, accompanied by robust conversion rates week after week.”

That conversion rate stayed at 59% last week, according to Black Book tracking.

And perhaps reflecting some “normalcy” on the retail front, too, Black Book said its estimated used retail days-to-turn is now at roughly 41 days, dropping by three days from a week earlier as spring and tax selling seasons gain steam.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

But if you’re still insistent on finding automotive gossip in the auction lanes, Black Book acknowledged one potential development in the report.

“Canadian exporters remain on steady ground despite the looming threat of higher tariffs,” analysts said. “Last week, business activities for these exporters appeared regular, with no immediate indications of a slowdown.

“The Black Book team remains committed to closely monitoring and reporting on the situation as it develops,” analysts added.

Should the situation involving tariffs intensify, the development would come as depreciation for the oldest used vehicles in the wholesale market are notable.

Black Book reported prices for cars 8 to 16 years old decreased by 0.64% last week, while values for trucks in that age range dropped by 0.55%.

Looking closer at a couple of specific vehicle segments, analysts indicated both subcompact cars and midsize cars sustained significant value declines last week, decreasing by 0.82% and 0.69%, respectively.

Over the past six weeks, Black Book said the sub-compact segment has averaged a weekly decrease of 0.79%, while the midsize segment has seen an average weekly decrease of 0.63% during the same timeframe.

On the truck side, a couple of specific segments are sustaining notable depreciation — the sub-compact and sub-compact luxury crossover/SUVs. Each one declined by more than 0.60% a week ago, according to Black Book.

In fact, analysts noticed the mainstream sub-compact crossover/SUVs have averaged a weekly decline of 0.68% during the past six weeks, while the luxury versions have averaged a weekly drop of 0.52% during the same period.