Lane watch: Waiting for election results to ripple into wholesale & retail

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Black Book noticed typical wholesale price movements as October concluded, with one anomaly being increasing values observed for small pickups that are 8 years old or newer.

But with Tuesday being both Election Day and the release of its newest installment of Market Insights, Black Book pointed to the run for the White House as a significant factor to influence what happens next in the lanes.

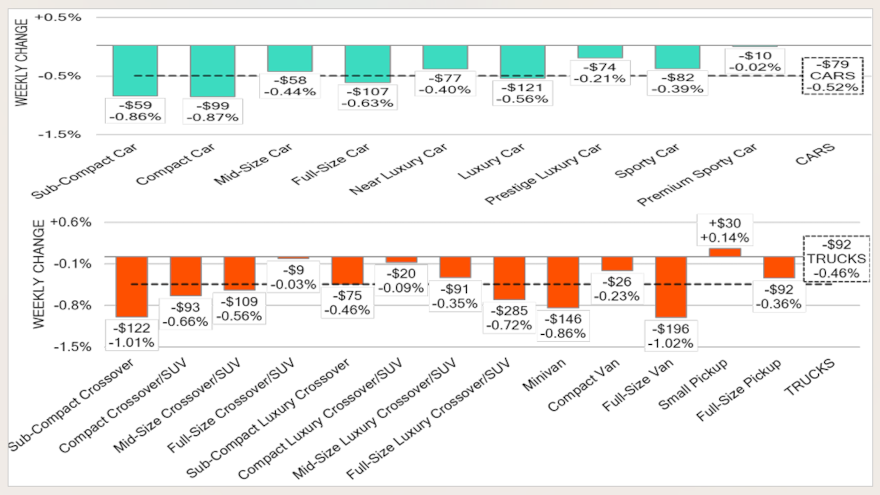

“All eyes will be focused on the outcome of the presidential election, as it has the potential to significantly impact the wholesale market in the coming weeks,” analysts said in the report, which indicated overall wholesale values decreased by 0.48% last week that included the end of October and first couple days of November.

“The fourth quarter usually experiences the highest depreciation compared to other quarters throughout the year. This year’s fourth quarter is following the expected seasonal depreciation for most segments,” Black Book continued.

Analysts mentioned their estimated used retail days to turn dropped again and is now at roughly 50 days. They also said the auction conversion rate stood at 58%, the same as the previous week.

“Last week marked the conclusion of October, during which depreciation increased almost steadily throughout the month,” Black Book said. Notably, subcompact crossovers and full-size vans experienced a depreciation exceeding 1% last week, representing the most significant weekly decline across car and truck segments for the entire month.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“We observed a slight decline in auction inventory, while the conversion rate remained stable,” Black Book added.

Touching on those aforementioned small pickups, Black Book noticed values for those units ticked up another 0.14% a week ago, representing the only one of the 13 truck segments to increase in price.

Analysts pointed out values of full-size vans and sub-compact crossovers both declined more than 1% last week, with decreases of 1.02% and 1.01%, respectively.

“The sub-compact crossover segment last saw a single week decline over 1% in December 2023, while the full-size van segment was in July of this year,” Black Book said.

In the car department, Black Book watched all nine segments sustain value decreases last week, with four segments experiencing depreciation readings of more than half a percent.

Leading the way were compact cars (down 0.87%) and sub-compact cars (down 0.86%), according to Black Book tracking, which also indicated depreciation accelerated for those units by 21 basis points and 31 basis points, respectively.

Perhaps with anticipation that Election Day results will be finalized without major incidents, Black Book reiterated, “as always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight.”