Lane watch: Why ‘affordability is crucial’ as wholesale prices tick up again

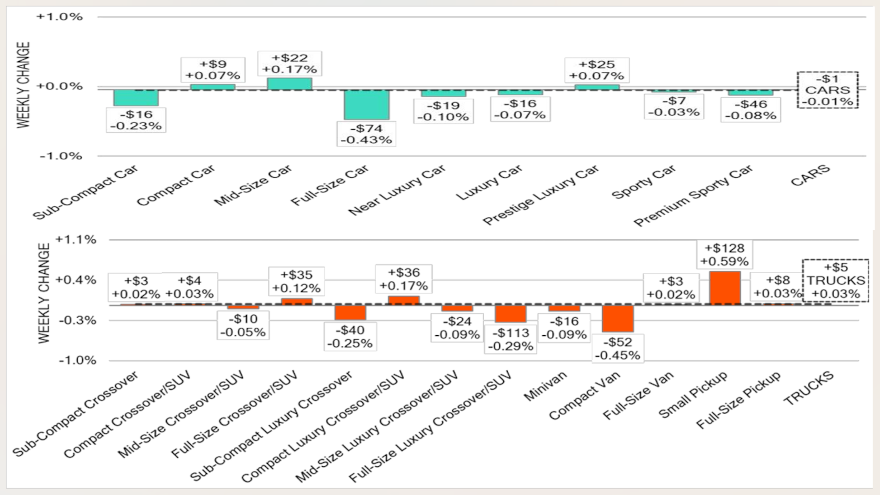

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Affordability has been a focus within the automotive retail and finance spaces for some time, with Edmunds revisiting it again in the past couple of days.

Well, on Tuesday, Black Book tackled the topic from the wholesale perspective, offering its analysis after watching wholesale values tick up another 0.02% during a time when prices usually are starting to fall like autumn leaves.

“Affordability is crucial for success in the wholesale lanes right now,” Black Book said in its newest installment of Market Insights. “Though the overall market remains stable, the strength lies in affordable segments like mid-size cars and small pickups, which had the largest increases last week. Interestingly, even older prestige luxury cars showed gains, primarily driven by models priced under $30,000.”

And here’s another trend that reinforced Black Book’s affordability assertions.

“Last week, auction lanes across the country experienced an increase in inventory,” analysts said in the report. “The auction conversion rate was 56%, a 3% drop from the prior week, marking the lowest rate since the third week of June this year.”

Furthermore, perhaps reflecting what Edmunds mentioned about consumers and their “sticker shock” when mingling in showrooms or scanning dealership websites, Black Book spotted another lift in the estimated used retail days to turn, which is now at roughly 47 days.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Where might dealers and used-car buyers find units that solve the affordability puzzle?

Black Book noticed prices for 8- to 16-year-old cars decreased 0.49% last week.

And values for full-size cars decreased another 0.43% a week ago. That’s after prices for those vehicles generated a 0.24% decline during the previous week, according to Black Book.

Analysts added prices for subcompact cars fell another 0.23% last week.

In the truck department, small pickups paced the value rises among seven of the 13 truck segments to post an increase last week in Black Book’s tracking.

Prices for small pickups jumped another 0.59%, marking the fifth consecutive week of gains with an average weekly increase of 0.32%.

“Despite rising incentives in the new market for some full-size trucks, the used market for 2-to 8-year-old models remains stable, with an average change of 0.03% over the past four weeks,” Black Book said.

Also of note, after 24 weeks of price declines, analysts noticed values for full-size vans edged up 0.02% a week ago.

With the affordability subject likely not to dissipate any time soon, Black Book reiterated, “as always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight.”