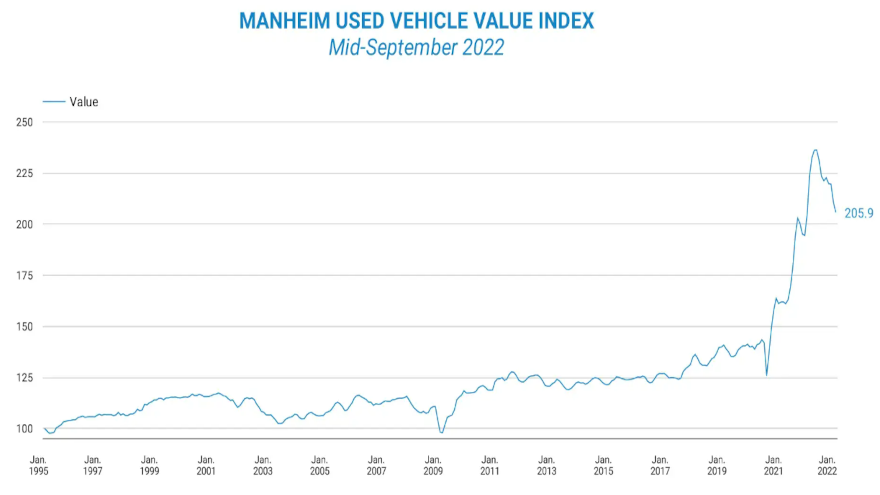

Wholesale prices continue notable downward slump at September midpoint

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Wholesale prices are softening so much that even year-over-year comparisons made by Cox Automotive show only modest differences.

Cox Automotive reported on Monday that wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) dropped 2.3% from August during the first 15 days of September.

The decrease left the Manheim Used Vehicle Value Index at 205.9, which was only 0.6% higher than the reading from last September.

According to a Data Point report, the non-adjusted price change in the first half of September represented a 1.4% decline compared to August, moving the unadjusted average price down 1.5% year-over-year.

Over the past two weeks, Cox Automotive noticed Manheim Market Report (MMR) prices demonstrated “higher-than-normal and consistent” declines, resulting in a 1.2% cumulative drop in the Three-Year-Old MMR Index, which represents the largest model-year cohort at auction.

During the first 15 days of September, Cox Automotive said MMR Retention — which analysts explained as the average difference in price relative to current MMR — averaged 98.4%, which indicated that valuation models are ahead of market prices.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Analysts also noticed that the average daily sales conversion rate of 49.4% in the first half of September dipped relative to August’s daily average of 50.1%, “but conversion rates typically decline in September.”

Cox Automotive added, “The latest trends in key indicators suggest wholesale used-vehicle values should see declines in the second half of the month.”

Analysts went on to say in the Data Point that four of eight major market segments saw seasonally adjusted prices that were higher year-over-year during the first half of September.

Cox Automotive reported that compact cars had the largest value increase at 7.0%, while vans and pickups outpaced the overall industry in seasonally adjusted year-over-year gains. Analysts added midsize cars matched the industry’s 0.6% gain.

“Compared to August, all major segments saw price declines, with full-size and sports cars down the most and pickups and compact cars down the least. The seasonal adjustment again amplified the declines, but all major segments saw unadjusted price declines in the first 15 days of September,” analysts said.

Elsewhere in the wholesale market, Cox Automotive mentioned rental risk prices are posting a moderate year-over-year increase.

Analysts determined the average price for rental risk units sold at auction during the first 15 days of September ticked up 2.0% year-over-year.

But rental risk prices softened 1.5% compared to Cox Automotive’s August information.

Analysts pointed out that the average mileage for rental risk units during the first half of September came in at 54,300 miles, a level 4.1% lower year-over-year and 3.9% lower month-over-month.

Cox Automotive closed its latest Data Point by touching on the amount of vehicles sitting at dealerships as well as at the auction yard.

Using estimates based on vAuto data as of Sept. 12, Cox Automotive said used retail days’ supply stood at 48 days, which was down one day from the end of August. Days’ supply was up seven days year-over-year but unchanged against the same week in 2019, according to analysts.

Leveraging Manheim sales and inventory data, Cox Automotive estimated that wholesale supply ended August at 27 days, down four days from the end of July but up seven days year over year.

As of Sept. 15, analysts said wholesale supply sat at 26.5 days, down one day from the end of August but up seven days year-over-year and six days lower than 2019.

“Used supply measured in days’ supply is back to normal, suggesting that price trends should normalize for the time of year,” Cox Automotive said.