Wholesale prices’ summer fall not expected to be as steep as 2023

Image courtesy of ADESA.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

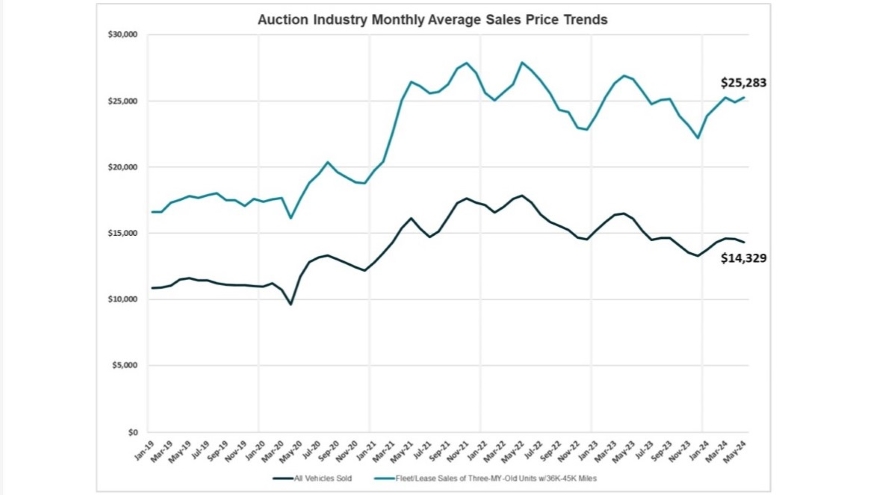

The downward trend in wholesale used-vehicle prices continued through May and the first half of June – but there are signs the rate of decline in the coming months could be slower than the steep drop of last summer.

In his latest Kontos Kommentary, ADESA chief economist Tom Kontos said wholesale prices averaged $14,329 in May, down 1.6% from April and 11.1% year-over-year – though still 23.4% higher than the pre-COVID level of May 2019. And by the week ending June 16, the average had fallen to $14,122.

Kontos said that decline has come “as the less-than-impressive 2024 spring/tax season market came to an early close.”

Going forward, he added, “wholesale and retail used vehicle market conditions are amenable to a less dramatic ongoing decline in prices than seen last year, as much of the correction to historical patterns of depreciation, seasonality and price-spread versus new vehicles has already taken place.”

The data from ADESA US Analytical Services’ monthly analysis of auction industry used vehicle prices by vehicle model class showed the largest biggest month-over-month decreases came from the popular compact SUV/CUV and compact car segments. Kontos said that could be an indication dealers need those vehicles less with the end of the spring market.

Values from both of those segments fell 4% or more in May, dropping their values close to pre-pandemic levels – compact SUV/CUVs at 5.3% above May 2019 and compact cars just 4% higher.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

While prices were down overall, the values of late-model used vehicles – defined as three-model-year-old vehicles with 36,000-46,000 miles on them – actually increased in May, though they have since softened in early June. As of the week ending June 16, the average price for those vehicles stood at $25,854.

Retail sales in /may were down 0.9% year-over-year and 14.5% from May 2019, according to ADESA US Analytical Services’ analysis of NADA and Motor Intelligence data cited in Kontos’ report. Franchised dealer used sales were off just 0.3% from the previous year while independents’ sales were down 1.5%.

Certified pre-owned sales were up slightly from May 2023.

“CPO sales … now represent one out of five in franchised dealer used vehicle sales,” Kontos said, “as consumers seek affordability and value.”