Manheim data shows wholesale prices down by 3.6% so far in August

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Black Book’s wholesale market experts aren’t the only ones seeing prices declining at a notable pace.

Cox Automotive also reported this week that wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) decreased 3.6% from July during the first 15 days of August.

Experts said that movement pushed the Manheim Used Vehicle Value Index down to 211.6, which was still 8.8% higher compared to August of last year.

Cox Automotive noted in a Data Point that the non-adjusted price change in the first half of August marked a 2.0% drop compared to July, leaving the unadjusted average price up 6.6% year-over-year.

Over the last two weeks, experts discovered Manheim Market Report (MMR) prices registered “higher-than-normal and consistent” declines, resulting in a 1.2% cumulative decline in the Three-Year-Old MMR Index, which represents the largest model-year cohort at auction.

During the first 15 days of August, Cox Automotive explained that MMR Retention — which is the average difference in price relative to current MMR — averaged 98.2%, “which indicates that valuation models are ahead of market prices.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Cox Automotive mentioned the average daily sales conversion rate of 51.3% in the first half of August increased relative to July’s daily average of 46.8% but remains lower than the typical conversion rate this time of year.

“The latest trends in key indicators suggest wholesale used-vehicle values should see declines in the second half of the month,” experts said in the Data Point.

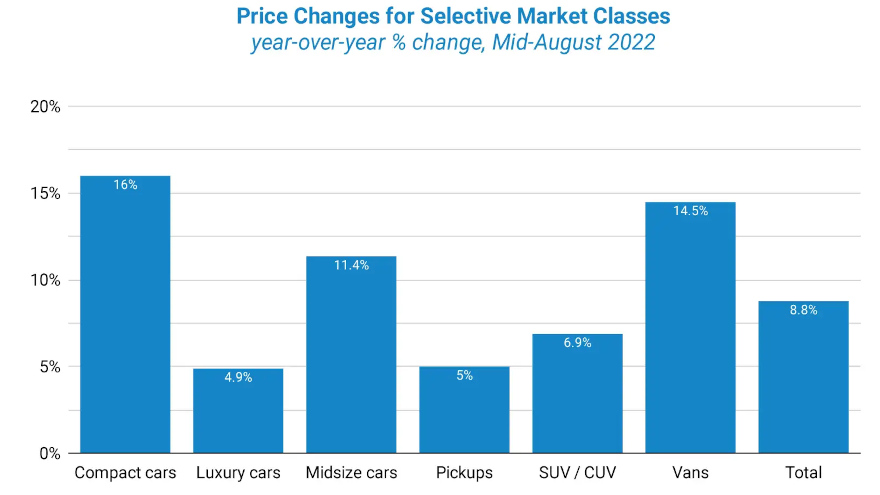

Cox Automotive pointed out all major market segments saw seasonally adjusted prices that were higher year-over-year in the first half of August.

Vans had the largest increase at 14.5%, while both non-luxury car segments again outpaced the overall industry in seasonally adjusted year-over-year gains, according to analysts.

Compared to July, Cox Automotive said all major segments saw price declines, with SUVs and pickups down the most and vans and compact cars down the least.

“The seasonal adjustment amplified the declines, but all major segments saw unadjusted price declines in the first 15 days of August,” analysts said.

Cox Automotive acknowledged that rental risk prices seeing smaller year-over-year increase.

Analysts determined the average price for rental risk units sold at auction during the first 15 days of August rose 16.8% year-over-year. Analysts added rental risk prices were up 0.1% compared to the full month of July.

Cox Automotive also noted that average mileage for rental risk units in the first half of August (at 57,988 miles) was down 17.2% compared to a year ago and down 1.4% month-over-month.

Elsewhere in the used-vehicle world, Cox Automotive reported retail and wholesale days’ supply sat at elevated levels by the middle of August.

Using estimates based on vAuto data as of Aug. 15, analysts said used retail days’ supply was 47 days, which was down four days from the end of July.

“Days’ supply was up eight days year over year and up two days against the same week in 2019,” analysts said.

“Leveraging Manheim sales and inventory data, we estimate that wholesale supply ended July at 31 days, up five days from the end of June and up nine days year over year,” they continued. “As of Aug. 15, wholesale supply was at 30 days, down one day from the end of July and up eight days year over year and five days higher than 2019.

“Higher than normal days’ supply indicates conditions that favor buyers over sellers,” Cox Automotive went on to say.

Cox Automotive closed its Data Point by noting consumer sentiment appears to be improving in August.

Analysts recapped the initial August reading on consumer sentiment from the University of Michigan increased 7% to 55.1.

“The increase was from improving future expectations as the view of current conditions declined,” Cox Automotive said. “The main worry in the data was the expected inflation rate in five years increased to 3.0% from 2.9% in July, but consumers’ expectation of inflation over the next year fell to 5% from 5.2% in July.

“Consumers’ views of buying conditions for vehicles declined as views of both prices and interest rates deteriorated,” Cox Automotive continue. “The only prior times consumers felt worse about auto loan interest rates than they do now was in 1980–1982, when rates were much higher.”

Analysts also mentioned the daily index of consumer sentiment from Morning Consult increased 4.9% in the first 15 days of August.

“The index has improved as gas prices have been falling. The average price of unleaded nationally was $3.95 on Monday, which was down 21% from the peak in June,” Cox Automotive said.