While Q3 dealer sentiment dips, index remains above 2020 & 2019 readings

Chart courtesy of the Cox Automotive Dealer Sentiment Index.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

ATLANTA –

Being the music aficionado he is, perhaps Cox Automotive chief economist Jonathan Smoke might recommend the 1980s hit song by Matthew Wilder titled “Break My Stride” to summarize the most recent Cox Automotive Dealer Sentiment Index (CADSI).

Even as tight vehicle inventory continues to vex the industry, store managers and principals still might be singing, “Ain’t nobody goin’ to break my stride,” as Cox Automotive discovered U.S. dealer sentiment in the third quarter softened a bit, but remains mostly positive and above levels recorded in Q3 2020 and Q3 2019.

According to a news release distributed this week, the current CADSI reading of 62 indicates that more dealers feel that the automotive market is strong compared to the number who feel that the market is weak.

Cox Automotive explained that the key drivers of sentiment saw varying shifts in Q3.

The three-month market outlook index generated a 3-point decrease from the prior quarter, meaning the outlook is waning. Although, Cox Automotive emphasized that since the reading is above 60, more dealers still see the future market as strong than see it as weak.

Analysts noted that the profits index saw a slight improvement compared to the prior quarter, hitting a record of 60. At the same time, the price pressure index increased modestly from Q2’s record low — slightly more dealers are now feeling pressure to lower prices, although that group is still in the minority.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Dealer sentiment has moderated from a record high in the spring,” Smoke said in the news release. “Dealers are still optimistic about the coming months, but the new-vehicle inventory situation is not improving, and sales are suffering.”

Perhaps as Wilder sang, dealers also believe that they “got to keep on movin’.”

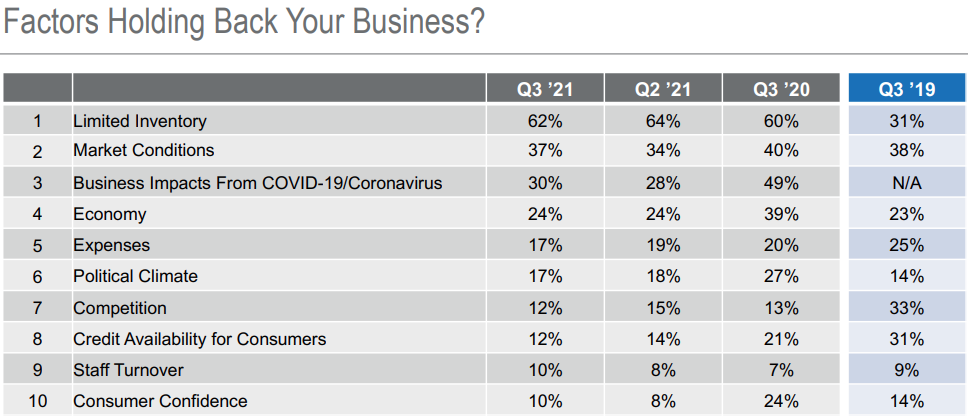

Cox Automotive went on to mention that the top five factors holding back the business across all dealers were unchanged in Q3 from Q2, with limited Inventory in the top spot with 62% of dealers citing it.

The index findings showed that market conditions came in the second spot, rising to 37% of dealers citing it, while business impacts from COVID-19 was in the third spot, down from No. 2 in Q3 2020.

The economy and expenses rounded out the top five factors holding back dealer business this quarter.

Analysts recapped that data for the Cox Automotive Dealer Sentiment Index is gathered via online surveys. The results were based on 1,100 dealer respondents, comprising 576 franchised and 524 independents, across the country from July 26 to Aug. 9.

Cox Automotive explained that dealer responses were weighted by dealership type and volume of sales to be representative of the national dealer population. For each aspect of the market surveyed, analysts said respondents are given an option that relates to strong/increasing, average/stable, or weak/decreasing, along with a “don’t know” opt-out.

Indices are calculated by creating a mean score in which:

— Strong/increasing answers are assigned a value of 100

— Average/stable answers are assigned a value of 50

— Weak/declining selections are assigned a value of 0

Respondents who select “don’t know” at a particular question are removed from the related index calculation, according to Cox Automotive, which said the full results of the Q3 2021 Cox Automotive Dealer Sentiment Index can be downloaded via this website.