Haig Partners: Dealer buy-sell flourishes, but stays below record heights of 2021

Chart courtesy of Haig Partners.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

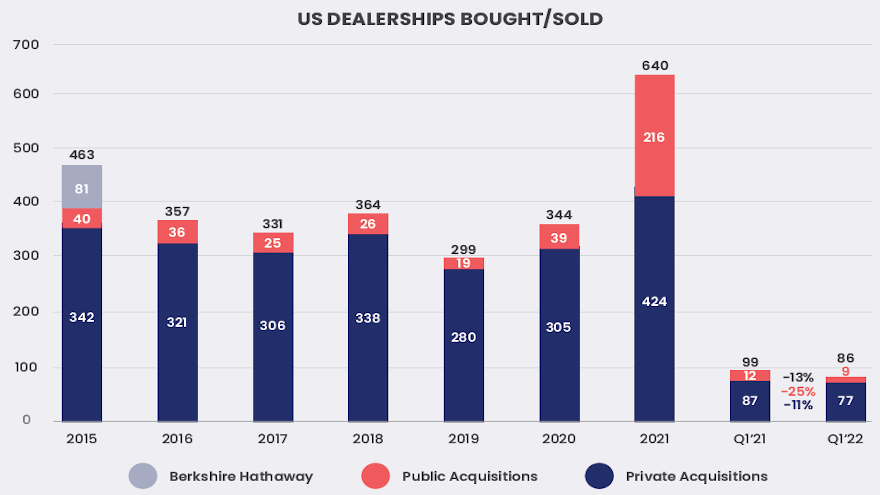

Dealership buy-sell activity is abuzz again in 2022, though it is not likely to reach the same staggering, record-setting heights of 2021, according to The Haig Report for the first quarter.

The report, which Haig Partners produces based on its own research and through using Automotive News and The Banks Report data, found there were 640 dealerships bought/sold last year — an all-time record that beats the prior high from 2015 by 38%.

There were 86 dealership purchases in the first quarter of this year, which is down from 99 in Q1 2021, according to Haig Partners.

Seventy-seven have been private deals and nine have been public acquisitions. In the year-ago period, 87 were private and 12 were public.

Interestingly enough, despite the publics buying few dealerships in the opening quarter of the year, they actually spent more, shelling out $588 million, compared to $434 million a year ago, Haig said.

And keep in mind, the public retailers spent $9.1 billion on acquisitions in 2021, an all-time record.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

As for why the spend was up for publics in Q1 2022, Haig Partners said: “They spent more money on fewer stores largely due to Group 1’s acquisition of Charles Maund Toyota in Austin, Texas for around $250M. We believe this is the most ever paid for a Toyota dealership, and perhaps the most paid for a dealership of any kind. Two words explain this record setting price: Toyota and Austin.”

Going back to more of the 2021 numbers, the aforementioned 640 stores sold beat the 2016-2019 annual average by 89%.

Of those sales, 424 were private acquisitions and 216 were public, Haig Partners said. The latter beat the prior five-year average by 645%, the company said.

As for what could be in store this year, Haig said: “Despite the decline, the outlook for the rest of 2022 is promising. Dealership profits continue to rise even higher, and many dealers are bullish about the outlook for auto retail. Prices will remain high. But it’s also possible that we won’t have as many megadeals come to market in 2022.”

Offering additional context in a news release, Haig Partners president Alan Haig said: “The first quarter of 2022 may bring auto dealers their highest profits ever. This is a uniquely good time to be an auto dealer.

“It raises the question as to how much longer these conditions can last. Our math indicates that the level of pent-up demand is so high that it will take three or more years before consumers will be satisfied and we would return to a situation where supply and demand would be in balance again,” Haig said. “During that time, dealers should enjoy profits that are elevated above the years before the pandemic and Chipdemic. Even so, there are risks on the horizon for dealers that include continued consolidation by the public retailers and ‘The Agency Model’ being pushed from the OEMs.”