3 main triggers of fourth straight quarterly decline in dealer sentiment

Chart courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Even dealerships are having some trouble keeping a bright outlook amidst the notable headwinds we’re all facing nowadays.

According to the latest reading of the Cox Automotive Dealer Sentiment Index (CADSI), U.S. automobile dealer sentiment in the second quarter softened, as U.S. dealers’ attention turned to inflation, high costs and tight inventory.

Analysts said the dip represented the fourth straight quarter-over-quarter decline in market sentiment. Cox Automotive indicated the current market index peaked at 67 in Q2 2021 and has been trending downward since.

Still, at 54, analysts pointed out the current market index remains above the positive threshold of 50.

Cox Automotive mentioned key drivers of sentiment saw disparate shifts in Q2.

The three-month, forward-looking market outlook index sharply dropped from the previous quarter and, at 53, is well below the 63 recorded a year ago in Q2 2021.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The economy index increased slightly in Q2 to 50, up from 49 in the prior quarter. With the index now at 50, dealers are right at the positive threshold in judging the economy as strong.

With COVID concerns mostly in the past, Cox Automotive chief economist Jonathan Smoke said that dealers are navigating challenges created by inflation, high costs and tight inventory.

“U.S. auto dealers are certainly feeling the pressure of inflation and tight inventory,” Smoke said in a news release. “Franchised dealers continue to be very profitable, but the steep drop in the market outlook index indicates dealers are less enthused about the future.

“While all dealers are impacted by higher costs of doing business, the profit story is also different for independent dealers, as used vehicles have started depreciating again,” he added.

Analysts noted the Q2 2022 CADSI research was in market from April 25 to May 9, when COVID cases had retreated from omicron-driven records and activity was normalizing compared to the situation in January.

More on the inventory crunch

Cox Automotive acknowledged one worrisome sign in the latest CADSI report is the small improvement in the new-vehicle inventory mix index for franchised dealers.

The index increased only two points from Q1 and remains historically low at 25, an eight-point year-over-year decrease.

“Today’s market continues to be framed by constrained new-vehicle inventory,” Smoke said. “Low new-vehicle inventory and the associated low level of incentives and lack of discounting have priced many would-be buyers out of the market and into the used-vehicle market.

“Others may be delaying purchases, waiting for supply to improve, but supply has yet to see much change,” he continued.

On the used-vehicle side, Cox Automotive found that the inventory index dropped in Q2 2022 to 35, one point lower than the previous quarter but up 14 points year-over-year.

Analysts indicated the used-vehicle inventory mix index improved among franchised dealers versus independent dealers, showing a 5-point increase year-over-year in Q2 to 55.

Cox Automotive added that all index scores associated with inventory, however, remain below the 50 threshold, indicating dealers are still facing significant inventory challenges for both new and used vehicles.

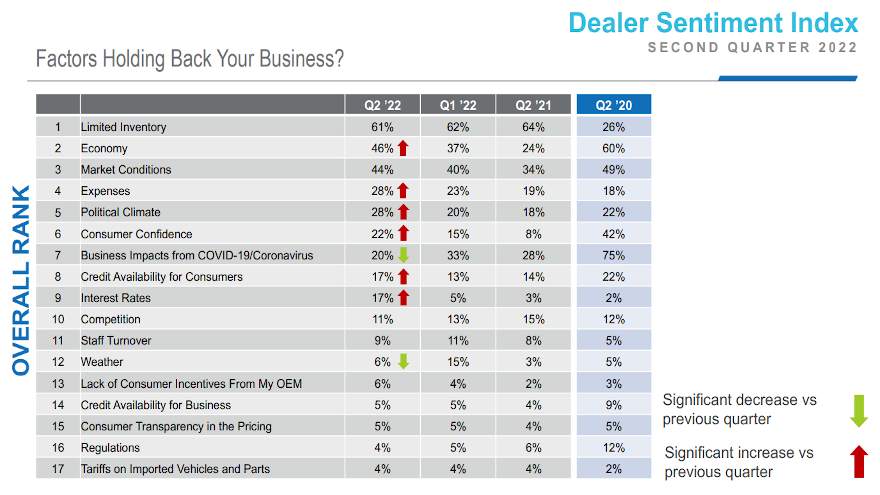

“Consistent with last quarter, limited inventory ranks as the No. 1 factor holding back dealer business in Q2,” Cox Automotive said.

While new-vehicle inventory remains tight, the newest sentiment report showed the view of new-vehicle sales improved, increasing from 50 to 52, meaning dealers are now more optimistic about new-vehicle sales. One year ago, the index score was 65, meaning significantly more dealers saw the market as good.

The new-vehicle incentives index dropped by 2 points quarter-over-quarter to 21, the lowest level since the question was added to the CADSI in Q3 2019.

On the other hand, analysts determined the used-vehicle sales index fell 5 index points to 47.

For franchised dealers, the used-vehicle sales index increased by 1 point for Q2, breaking a downward streak but is still below year-ago levels.

For independent dealers, the index fell 6 points from the previous quarter to 42 and is down 14 points from a year ago.

“Overall, most dealers view used-vehicle sales as weak,” Cox Automotive said.

Dealers worried about the economy & costs

Perhaps this component of the latest CADSI should be the least surprising

In Q2 2022, the cost index — specifically the cost of running a dealership — was at the highest level since the survey began in 2017.

After reaching a record low in Q2 2020 of 51 at the height of the pandemic, the cost index has been steadily increasing, according to Cox Automotive, which said, “Overall inflation in the U.S. economy is clearly contributing to this view.”

The CADSI report noted that the economy is the second leading factor impacting dealer business at 46%, up from 37% in Q1, with market conditions, expenses and political climate following closely behind.

“Dealers are worried about inflation and the possibility of a recession along with lagging consumer confidence,” Cox Automotive said.

Profits remain strong for franchised dealers

Here’s an area that’s remaining strong during this turbulence.

Cox Automotive mentioned the overall profit index saw a small decline to 53, down from 54, but remains higher than at any point before the COVID-19 pandemic.

Analysts recapped that the five highest profit index scores since 2017 have all been recorded in the past five quarters.

However, Cox Automotive pointed out that the profit index also indicates that franchised dealers believe profits are particularly strong, at 82, whereas more independent dealers now see profits as weak, with an index score of 44.

“Importantly, the cost index increased by 11 points in Q2 versus a year ago and reached a new record high of 76, suggesting that the overall cost of running a dealership continues to grow,” Cox Automotive said.

“On the plus side, the price pressure index increased only slightly in Q2 to 41, up from 37 in Q1, but remains historically low, indicating fewer dealers feel pressure to lower their prices,” analysts added.

Other trends to watch

Cox Automotive reported that the top 5 factors holding back the business across all dealers saw minor shifts in Q2. But analysts said three factors — economy, expenses and political climate — saw significant quarter-over-quarter increases.

Limited Inventory remains in the top spot. The economy rose to No. 2 ahead of market conditions. Expenses ranked fourth overall, while political climate rounded out the top 5 factors.

Notably, COVID-19 is no longer a top factor holding back business, falling to No. 7.

Cox Automotive Dealer Sentiment Index methodology

The Q2 2022 CADSI is based on 1,099 U.S. auto dealer respondents, comprising 568 franchised dealers and 531 independents.

Dealer responses were weighted by dealership type and sales volume to represent the national dealer population.

Analysts explained that for each aspect of the market surveyed, respondents are given an option related to strong/increasing, average/stable, or weak/decreasing, along with a “don’t know” opt-out. Indices are calculated by creating a mean score in which:

—Strong/increasing answers are assigned a value of 100.

—Average/stable answers are assigned a value of 50.

—Weak/declining selections are assigned a value of 0.

The entire report can be downloaded via this website.