Lane watch: Typical April trends already being seen in March

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Being about a month ahead of schedule often is a good thing, like completing an expensive or long-term project.

Evidently, the wholesale market might be that far ahead of schedule, too. Black Book explained the situation in this week’s installment of Market Insights.

“The market had another impressive week,” analysts said in the report that also mentioned last week’s auction conversion rate ticked a bit lower to 64%.

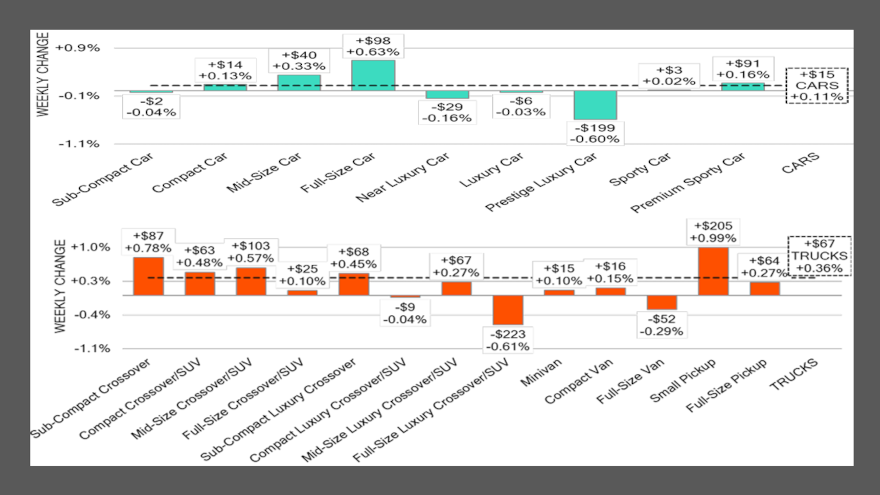

“To put it into perspective, the average value of 2-to-8-year-old vehicles rose by 0.29% last week, surpassing the highest pre-pandemic spring market weekly increase of 0.12%,” Black Book said. “Typically, the largest spring market increase occurs in mid-April, not mid-March.”

No matter what might be unfolding at the auction, perhaps dealerships are a bit ahead of their monthly targets for used-car sales. Black Book noticed its estimated used retail days-to-turn dipped slightly and is now at roughly 43 days.

Meanwhile for consignors, the spring market is time for making hay, especially if they have full-size cars and small pickups to send down the lanes.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Black Book reported that while a smaller part of the wholesale car world, full-size cars rose in value at a record clip, with prices jumping 0.63%. Those units now have appreciated for three consecutive weeks.

Analysts noticed the small pickup segment generated nearly a 1% increase in value last week, representing its largest single-week gain since May 2021.

Even pockets of older units are moving up in value. Black Book spotted 8-to 16-year-old trucks recording their first price increase since late last March, ticking up by 0.05%. And values for compact vans in that age category shot up by 0.47% last week, according to Black Book tracking.

Among late-model units that could be certified and appeal to buyers with tax refund money, analysts reported values for subcompact crossovers less than 2 years old spiked by 0.88%, the largest single-week gain recorded by those since 2021.

Also, Black Book said prices for compact cars less than 2 years old rose by 0.40% last week.

Analysts wrapped up their latest wholesale-market observations this way.

“Once again, last week the truck segments outperformed the car segments, with the truck segments showing positive movement for the third straight week, while the car segments reported upward momentum for the second consecutive week,” Black Book said.

“One trend we’ve been monitoring since mid-February is the large number of vehicles being sold in the OEM lanes,” analysts continued. “As we conclude the third week of March, this trend continues, with an increasing number of OEMs placing more vehicles in the auction lanes.

“As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight,” Black Book went on to say.