5 factors to drive dealership buy/sell activity

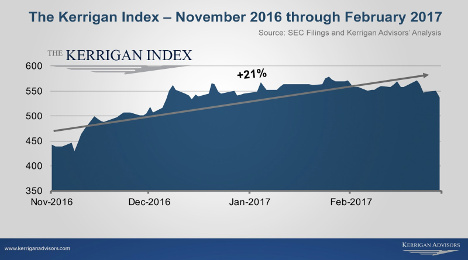

Graphic courtesy of Kerrigan Advisors

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

FORT LAUDERDALE, Fla., & IRVINE, Calif. –

Two firms — Haig Partners and Kerrigan Advisors — each shared upbeat reports about the “robust” outlook for dealership buy-sell activity.

In fact, The Blue Sky Report from Kerrigan Advisors went so far as to say dealership buy/sell activity is set to rebound to record levels in 2017 as the firm released its analysis for the full year of 2016.

Although there was what Kerrigan classified as a slight decline — 8 percent — in overall transaction activity a year ago, and rising real estate costs are set to present a challenge for buyers, the report indicated what’s driving robust optimism are five factors, including

—An increase in “serious” sellers coming back into market

—Improved valuations

—Private buyer demand for large acquisitions

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

—Advantageous market fluctuations

—The “Trump Bump”

“Most dealers understand that the opportunity has passed to obtain above-market blue sky prices and, instead, are satisfied knowing that today’s valuation levels are still very high, particularly on a historic basis,” said Erin Kerrigan, managing director of Kerrigan Advisors.

“Buyers are finding pricing more reasonable in part because today’s sellers are serious about a sale. The market testers who were seeking ‘crazy’ blue sky values have primarily returned to operating their businesses, discovering those unrealistic values were not attainable,” Kerrigan continued.

Laying out the high, average and low multiples for each franchise in the luxury and non-luxury segments for the quarter, the report is geared to offer a detailed view of public and private company dealership acquisition activity. Other key findings from the report include:

• 221 dealership buy/sell transactions were completed last year, compared to the record of 241 transactions in 2015.

• 57 multi-dealership transactions were completed last year, resulting in an 8 percent increase over that 2015 record.

• Ford, Chevrolet, Toyota, Honda and Subaru are likely to be chief targets of acquisition activity.

• Domestic franchises saw their buy/sell market share increase by 42 percent in 2016.

• With truck sales still on the rise, domestic buy/sells will continue to dominate the 2017 buy/sell market.

• Public auto retailers’ acquisition spending decreased 21 percent in 2016 compared to 2015, with Lithia and AutoNation the only publics to make acquisitions of U.S. dealerships in 2016.

• Publics sold nearly as many dealerships as they acquired.

• The private sector acquired 89 percent of the franchises sold in 2016.

• The average dealership’s real estate value is estimated at $10.3 million, while the average dealership’s blue sky (goodwill) value is estimated at $6.6 million.

The report also identifies the following four market trends, which Kerrigan Advisors expects to affect the buy/sell market in 2017 and beyond. They included:

• Buyers’ return on investment parameters drive buy/sell activity

• Sellers’ pricing expectations rationalize with a plateauing market

• Buyers seek investments in higher margin auto retail business segment

• Dealers are increasingly open to equity and growth capital partners

“Overall, we expect 2017 to be a very active year for buy/sells with private and more public buyers eager to put their capital to work. We find an increasing number of sellers coming to market motivated by current prices and a strong desire to capitalize on today’s buy/sell activity,” Kerrigan said.

“As more dealers find their succession plans have run their course, we expect the number of sellers to rise, given the generational shifts underway in auto retail and the aging of the U.S. dealer network,” she went on to say.

The Blue Sky Report, a Kerrigan Quarterly, is published four times a year and includes Kerrigan Advisors’ signature blue sky charts, multiples and analysis for each franchise in the luxury and non-luxury segments. The multiples are based on Kerrigan Advisors’ view of franchise values in the current buy/sell market and can be applied to adjusted pre-tax dealership earnings to estimate blue sky value.

To download the Kerrigan Advisors report, go to this website.

Haig Partners findings

The number of dealerships sold in the U.S. declined 6.5 percent from the peak levels reached in 2015, according to data published in the 2016 year-end edition of the Haig Report.

Haig Partners indicated demand shifted from luxury and import brands to domestic brands that are heavier in trucks and SUVs. The firm also said most franchise values remain unchanged.

Despite a decline in the number of dealerships sold, Haig’s report also mentioned the number of dealership groups sold increased 17.6 percent, as their owners took advantage of market conditions to exit the industry.

Haig went on to state demand for dealerships remains strong with public dealer groups, private dealer groups and institutional investors all looking for fairly priced acquisition opportunities.

The Haig Report is based on data gathered from many public sources, as well as interviews with leading dealer groups, and bankers, lawyers and accountants who specialize in auto retail.

Key findings from the 2016 Year End Haig Report include:

—357 dealerships sold in 2016, down 6.5 percent from 2015.

—Public company spending on U.S. auto dealerships fell 14.5 percent from 2015 as they spent more of their capital on stock buy-backs, European auto dealerships and truck dealerships/leasing.

—Sales of dealership groups increased 17.6 percent from 51 groups in 2015 to 60 groups in 2016, as owners took advantage of conditions to exit near all-time high valuations.

—21 percent fewer luxury dealerships sold, 25 percent fewer midline import dealerships sold, while sales of domestic dealerships increased 31 percent as compared to 2015.

—Macroeconomic indicators such as GDP, interest rates, employment, number of miles driven, gas prices and consumer sentiment are all highly favorable for dealers at the moment.

—Other trends such as used-vehicle pricing, incentive spending by the OEMs and loan losses are growing less favorable to dealers.

—Haig Partners average blue sky multiple fell 2.9 percent from 2015.

—Average profits per dealership fell 2.4 percent compared to 2015 to $1.467 million per dealership.

—Average estimated blue sky values per dealership dipped 5.4 percent from to 2015 to $6.83 million.

—Private equity firms and family offices are increasingly active and making substantial investments in auto retail.

“Despite the small contraction in 2016, we expect 2017 will be another strong year for dealership buy-sell activity,” said Alan Haig, president of Haig Partners. “There remain many buyers looking for dealerships, financing is still readily available, and more sellers are realizing that if they want to sell their dealerships before the next recession they will likely need to accept today's offer since tomorrow's offer could be lower.

The 2016 Year End Haig Report also addressed the potential impact of the Trump administration on the value of dealerships. The report found values could go up if regulations are reduced, taxes are reduced and we enjoy faster economic growth, or down if we face higher interest rates, trade wars, escalating international tensions or a recession.

Haig Partners is seeing these conditions in its current engagements that include domestic, import and luxury dealerships that range from Florida to New York to California. The value of the transactions they have closed over the past two and a half years is approximately $900 million, including two of the largest transactions of 2016, so they have unique insights into current market conditions and how they impact dealership values.

The Haig Report is published each quarter and is a valued source of information to many in the auto industry who look to it for its comprehensive data, analyses and opinions about the auto retail industry. Included in each edition are Haig Partners' blue sky multiples that serve as a gauge for franchise values.

To download the Haig report, go to this website.