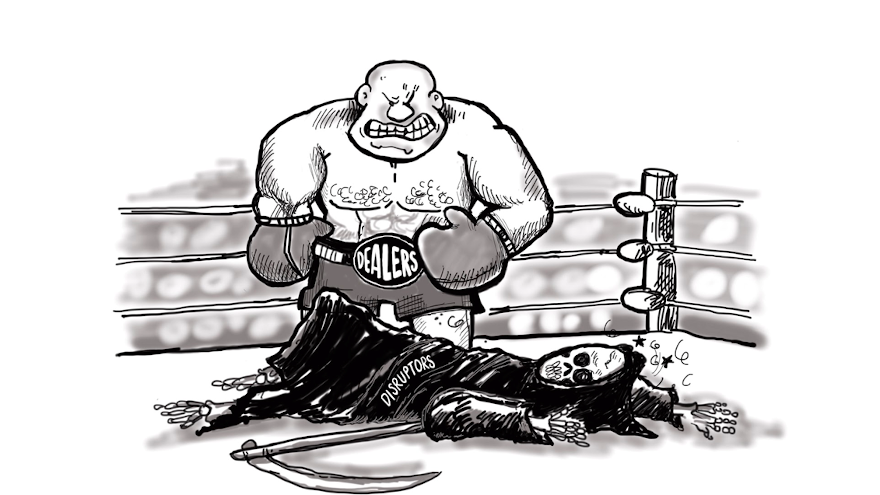

COMMENTARY: Did COVID-19 just help dealers deliver a knockout punch to disruptors?

Photo credit: Cartoon courtesy of Brian Allan. Used with permission from Allan. Artwork by Steve Bolton. Copyright: Respective.io, LLC.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Alex Fraser, a well-respected auto industry veteran, once said “never bet against a car dealer” during a NADA panel Q&A. He humbly gave credit for the quote to his friend, Todd August. It appears both gentlemen may have just been validated.

Analysts have recently issued investment advice that would be unthinkable just a few months ago, “invest in retail dealer groups.” In fact, J.P. Morgan published a favorable opinion that recommends “dealers as an attractive investment,” as shown in this Seeking Alpha post.

However, J.P. Morgan may be late to the party. Most publicly traded dealer groups have fully recovered from, or exceeded, recent share price collapses. Furthermore, private dealer acquisitions are flourishing at record prices.

As we bear witness to the unprecedented events happening today, we should resign to the realization that the current crisis is not a blip in history, but rather a defining point that will have lasting implications on the automotive industry moving forward.

Current events are instilling monumental and permanent changes in consumer and employee behavior. However, it appears that the changes are increasing opportunities for automotive retailers. Many have said that one needs to be out of their comfort-zone to grow. Because of Covid-19, dealers are experiencing unprecedented breaks from their comfort-zones. Recent reports support that the industry is taking advantage of this once-in-a-lifetime opportunity to reset business strategies and processes as a result.

Dealers have consistently faced criticisms that they are slow to adapt and irrelevant in a digitally based ecommerce world. Many pundits have said that if it were not for the protection of franchise laws, the dealership model would not exist today.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

I have a different opinion.

Dealerships provide an essential safety valve between manufacturers and the marketplace. Manufacturers have a difficult job. They must forecast trends, consumer preferences, and macroeconomic environments years in advance. Dealers provide the front-line expertise and elasticity to deal with the inevitable variations from OEM forecasts (enter COVID-19).

As Mike Tyson famously said, “Everyone has a plan until they get punched in the mouth.” Dealers are the ultimate fixers. More importantly, they are closest to the customer and serve to inform the manufacturer of real-time customer trends versus what may be biased opinions from focus groups. Having served on many OEM dealer advisory boards, I know this all too well.

As important as dealers are to the automotive ecosystem, dealers must rely on positive cash flow to survive. Everything I learned in Economics 101 applies to operating dealerships. Wall Street and Silicon Valley seem to exist in an alternative universe. Revenues and growth tend to be rewarded over profitability with so-called “disruptors” (maybe not for long going forward.)

Dealers are true entrepreneurs with an incredible sense of timing and real-world survival skills. Dealers know that being a close follower can have its advantages and often enjoy the spoils of war from those less experienced.

Today, savvy dealers are implementing technologies and processes from ’disruptor’ companies that invested millions, or even billions, trying to compete with established dealers.

In fact, some tech-based disruptors that preached the pending demise of dealerships have found a new religion. To survive, many disruptors realized that they must partner with the very beast that they professed was on the verge of extinction.

Success is the best revenge.

The following opportunities are now rapidly being employed by progressive dealerships and quickly gaining mainstream traction:

- Customer-centric processes and technology

- Dealer-based vehicle subscription programs

- Alternative finance solutions using the latest telematic and payment technology

- On-demand rentals for commercial & leisure

- Omni-channel sales & service options

- 24-hour customer engagement tools

- Home pick-up & delivery for sales & service

- Applying automation, AI, and machine learning applications to marketing efforts

- Employee empowerment

- Comfortable environments for employees and customers

- Online to in-store seamless sales & service processes

- Flexible and remote employee work options

Ironically, what many dealer critics claim to be a weakness is a unique strength, operational independence from manufacturers. Dealers can pivot quickly as individual businesses.

Dealer critics fail to consider that dealers are closest to the customer. Dealers are often their community’s largest benefactor. Additionally, dealers typically own the infrastructure, including the real estate. As a result, dealers are in the best position to pivot quickly with innovation, when appropriate.

Some critics have touted that dealers will become irrelevant in a world where less cars may be privately owned. Who best to operate fleets that a customer may want to subscribe to, or rent as needed? New mobility options only reinforce the need for dealers that are local and have the infrastructure in place to serve new opportunities such as electric and autonomous vehicles.

The dealer is the lowest-cost-solution provider for innovative transportation models such as subscription programs, on-demand leisure rentals, commercial rentals for rideshare or delivery services, and in the future, autonomous fleets.

Further ensuring dealers’ sustainability, innovative digital tools and processes are lowering the dealer’s operational costs while improving the customer experience.

Dealers do not have to increase headcount to increase volumes. Equally important, dealer employees are enjoying the changes. The culture of dealerships is quickly changing from adversarial to consultative. Preference to a dental visit versus buying a car is quickly becoming a passé comment. Better yet, recent third-party surveys are validating consumers’ delight with the innovative dealer processes. Even better, surveys also indicate consumers will buy vehicles more frequently because of the better purchase experience.

It appears Wall Street recognizes the potential dealers have before them. The more I think about it, J.P. Morgan may not be late to the party. It may have only just begun.