Equifax Examines Complexities of Online Ads for Leasing

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

ATLANTA –

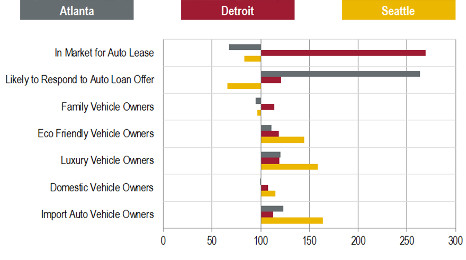

Equifax recently considered the difficult online advertising challenges faced by automakers, ad agencies, finance companies and dealers and how they can vary greatly by region. Analysts dissected trends from three major markets — Atlanta, Detroit and Seattle — in association with leasing potential.

Equifax found that these three markets demonstrate how complex it is to put the right message in front of optimal customers.

“A consumer may aspire to own a luxury sedan, but they may not be able to afford it, or they may need to buy a family car instead. That’s why it’s important for all of these groups to reach the right audience with the right offer for their brands and models,” Equifax’s Jeff Sporn wrote in a blog post on the company’s website.

“The easiest way to do this is to differentiate online consumers in real-time by understanding their preferences,” Sporn continued. “Many online advertisers simply focus on ‘auto intenders;’ but what, exactly, is the ‘intent’ of the intender? Auto marketers need deeper information that helps them determine whether an online consumer is more likely to purchase a luxury car versus a minivan. Or whether they prefer a loan or a lease. Armed with this insight, auto marketers can reach the right audience. When you deliver the right message to the right consumer you can significantly improve the ROI of your online spend.”

With those considerations in mind, Equifax examined trends originating from Atlanta, Detroit and Seattle and summarized them in the chart above. This information was compiled using the Equifax IXI auto-specific digital targeting segments. The bars represent an index value indicating how much more or less likely the cities are to have the listed attribute than the national average of 100.

“We can see clearly that Detroit is far above the national average when it comes to consumers likely to be in-market for an auto lease, while the other two cities are well below,” Sporn said. “Atlanta has more consumers likely to respond to a loan offer, while Detroit is also above the national average. Seattle is well below the national average, so advertisers extending lease or loan offers could divert their budget toward consumers in the other two cities.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Sporn went on to mention another element about Seattle that makes it unique compared to the other two markets included in this study.

“The city indexes highest for luxury vehicle owners, eco-friendly vehicle owners, and import vehicle owners. Using other measures, we know that 17.0 percent of Seattle’s population is likely to have income greater than $150,000 (compared to 11.6 percent for Atlanta and 9.5 percent for Detroit),” Sporn said. “This means that Seattle is clearly an area that luxury brands will want to target, especially foreign brands and eco-friendly models. Their ads are likely to resonate better in the Northwest than in the other two cities.”

Sporn made one last point about the important of targeted online marketing.

“It’s important to note that these segments do not include any personally identifiable information so brands are not actually targeting or tracking known individuals,” he said. “Segments are estimates of likely household characteristics built using anonymous, aggregated, neighborhood-level data.”