Lotlinx: Q3 shows high day supply, largely aging vehicle inventory

Charts courtesy of Lotlinx.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Here’s more evidence the used-car market is a complex place nowadays.

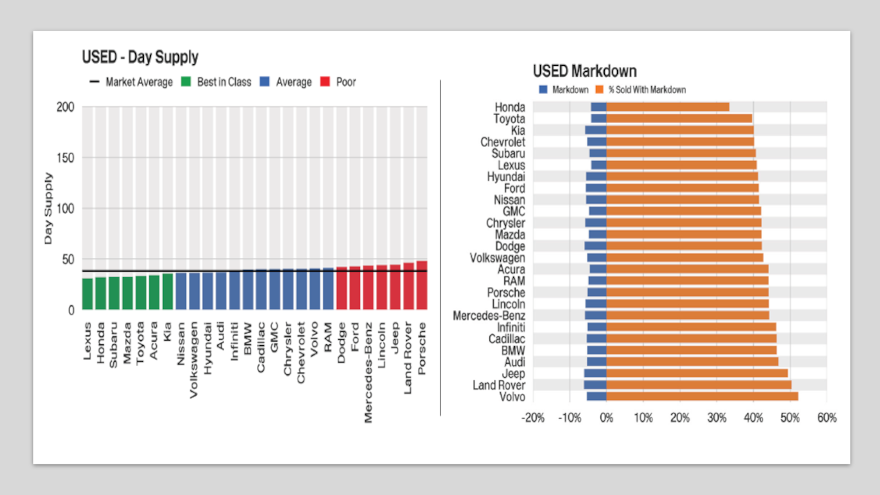

According to the Q3 Quarterly Vincensus Report, Lotlinx acknowledged while certain brands face issues with high day supply and a largely aging inventory, others are struggling with supply constraints.

When it comes to inventory dynamics unfolding during the third quarter, the report highlighted complex trends across the industry, including:

—New overall day supply increased to 74 days, up 6 days quarter-over-quarter and 28 days year-over-year

—New aged ending inventory decreased by 3% quarter-over-quarter but increased by 13% year-over-year

—Both new and used carryover inventory increased, with new up by 6% and used by 7%

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Lotlinx pointed out the automotive market is experiencing a notable shift toward electrification, stemming from:

—New EV sales increased by nearly 30%

—New Hybrid sales grew by 21%

—New EVs were the only engine type to see a decrease in day supply, dropping by 11 days

—Used EV day supply continued to decrease, falling by another two days quarter-over-quarter to 44 days as hybrids and gas day supply remained steady.

Lotlinx mentioned a couple of brand-specific insights, including:

—New Cadillac carryover inventory saw a significant 25% increase, driven by a 40% rise in LYRIQ inventory

—Volvo increased the number of units sold with markdowns on new vehicles by a market-high 11%, while Chrysler decreased by 4%

Lotlinx executive chairman Len Short stressed report findings show the value of the company solutions, including:

—Lotlinx customers had 1% less aged inventory than the market average for new vehicles and 3% less for used vehicles

—44% of new vehicle brands and 93% of used vehicle brands outperformed the market as Lotlinx customers

“Auto dealers today continue to face multifaceted challenges with brand-specific inventory risk, aging carryover, and markdown strategies,” Short said in a news release. “Our Q3 Vincensus Report highlights these complexities, such as Cadillac’s 25% increase in carryover inventory and the varied approaches to markdowns across brands like Volvo and Chrysler.

“To navigate these challenges successfully, dealers need more than just raw data — they require sophisticated data technology and access to reports like Vincensus, AI-driven insights, and predictive modeling,” Short continued. “By leveraging advanced analytics, dealers can anticipate market shifts, optimize their inventory mix, and implement dynamic pricing strategies that respond to real-time market conditions.”

The entire report that offers insights into the current state of the automotive retail market for both new and used vehicles, inventory risk, vehicle sales, consumer preferences and markdown/pricing strategies can be downloaded here.