Honcker scores $3.6 million in seed funding

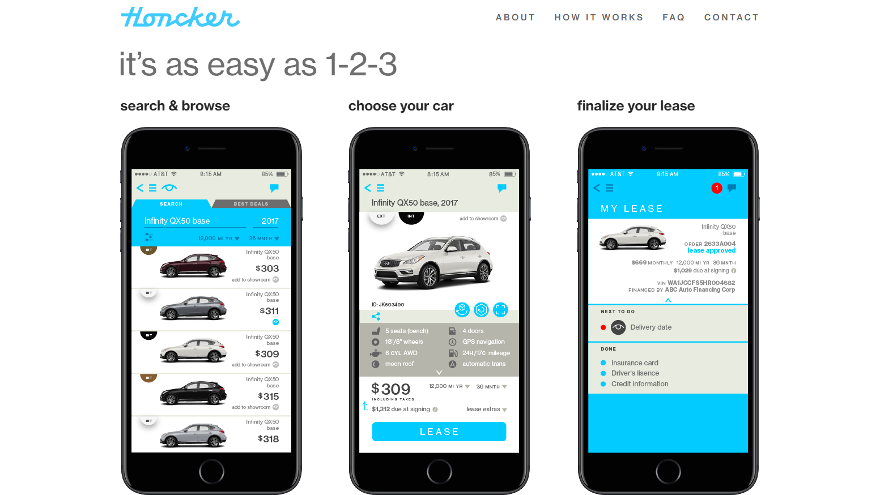

Screenshot from Honcker.com

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

CARY, N.C. –

Online car leasing marketplace Honcker closed a seed financing round of $3.6 million on Thursday, and said it will now provide delivery to customers in eight states.

Honcker plans to use the round, which was led by Evolution Corporate Advisors, to grow its dealership network, geographic footprint and customer base.

Additionally, Honcker will use the funds for creating more features to help streamline the car-leasing process, it said.

“Consumers never need to visit a dealer again to lease a car. Honcker is disrupting the traditional leasing experience for customers while digitally extending the rooftops of its dealer-partners,” Evolution founding partner Gregg Smith said in a news release.

In addition to Evolution, also participating in the round was Lead Edge Capital.

Honcker now has 200-plus dealer partners and is available in the New York Tri-State area, Los Angeles, Arizona, Nevada, Pennsylvania and Florida, the company said in a news release.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Honcker is revolutionizing the automotive industry by bringing the entire car leasing process online — from selection to pricing to closing — and providing a seamless lease execution process that can be completed by a consumer in just minutes from the convenience of their own home on their mobile device,” Honcker founder and chief executive Nathan Hecht said in a news release. “This injection of capital from our new value-added partners will now allow us to truly step on the gas.”

This news came a day before another company in this space, Fair, announced two major investments.

Fair, an app that provides used-car leasing to consumers on a flexible basis, said Friday it is closing a BMW i Ventures-led strategic funding round that also includes investments from Penske Automotive Group, among other strategic investors.

Additionally, Fair has secured a total of nearly $1 billion in offers for dedicated capital coming from two entities: a group of institutional investment banks typically backing auto debt portfolios and a Sherpa Capital-led entity. The latter entity is being developed to fund projects innovating the transportation industry, including ride-sharing and flexible ownership.

The interest in flexible and/or alternative vehicle shopping and ownership appears to be palpable of late.

On the same day (Oct. 10) that Porsche Cars North America announced it was teaming up with Clutch Technologies to pilot a sports car and SUV subscription program in Atlanta, Hyundai launched a Shopper Assurance program the company says “streamlines and modernizes the car-buying experience” by making four often-challenging elements of car-buying easier, including moving some of the process online.

Then the following week, alternative leasing platforms Fair and Honcker land huge investments.

In a recent phone interview, Hecht explained what he believes had led to a groundswell of interest in alternative leasing.

“It’s a combination of a few different things, but the first thing I’d highlight is time,” Hecht said. “For the first time in the automotive industry, there’s actually innovation happening. And innovation on many different levels. It starts with the vehicle itself: self-driving cars, electric vehicles and so on. And now it’s starting to trickle down all the way through the entire auto experience.

“So once there’s innovation, it attracts capital. Once capital is available, the entrepreneurs sort of start to breathe. And the result is that there’s a lot of very interesting things going on. And I think it’s still very early days and there’s huge opportunity,” he said.

That opportunity, for Honcker, began to take shape Thursday.