Plucking potential used-car wisdom from J.D. Power Sales Satisfaction Study

Charts courtesy of J.D. Power.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

TROY, Mich. –

Perhaps there are some strategy recommendations to help dealerships sell used vehicles that can be plucked from the J.D. Power 2021 Sales Satisfaction Index (SSI) Study, which focuses on retailing new models.

Three of the four key findings might be especially relevant to used departments since they are associated with subjects such as trade-in values, inventory availability and digital retailing.

According to study results released on Wednesday, overall sales satisfaction remains at 789 points (on a 1,000-point scale). Satisfaction among dealers where buyers purchased their vehicle increases 2 points to 841, while satisfaction with rejected dealers declined six points to 632.

J.D. Power — the presenting sponsor of Pre-Owned Con at Used Car Week that begins Monday in Las Vegas — said the buyer satisfaction increase was buoyed by buyers receiving more money for their trade-in than they expected at the time of new-vehicle purchase.

Year-over-year, J.D. Power reported that the percentage of buyers who got more than they expected for their trade-in increased 9 percentage points in the mass market segment and increased 8 percentage points in the premium segment.

However, J.D. Power pointed out that satisfaction among vehicle buyers significantly decreased year-over-year in the inventory-related factors for website (down 14 points) and at the dealership facility (down 16 points).

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Despite the lack of inventory, dealerships have overcome what might be thought of as a challenging sales environment for shoppers,” said Chris Sutton, vice president of automotive retail at J.D. Power. “Right now, it’s hard to see the light at the end of the supply chain tunnel, so dealerships need to continue to sell vehicles through their inbound pipeline and help customers with special orders.

“However, the silver lining for customers is that trade-in values remain high and this has had a positive effect on customer sales satisfaction,” Sutton continued in a news release.

The study also mentioned that satisfaction with the variety of dealership inventory significantly decreased 0.55 points (on a 10-point scale) among mass market shoppers and 0.42 points among premium shoppers during a three-month period from March through May 2021.

Other key findings of the 2021 study included:

— If you build new vehicles, buyers will come

J.D. Power acknowledged that manufacturers struggling most with inventory shortages are losing shoppers to competitors.

The percentage of shoppers rejecting a brand due to inventory shortages is most prevalent among domestic truck brands — Ram (37%) GMC (36%) and Chevrolet (35%). Genesis has the highest percentage of rejecters (39%) among all brands because dealerships didn’t have the exact vehicle they wanted, which is 14 percentage points above the industry average of 25%.

“The good news for dealers is that 78% of rejecters who reject a dealership due to inventory shortages indicate they will consider the dealership for future vehicle purchases. In other words, they’re not blaming the retailer for an inability to find their new vehicle,” Sutton said.

— Buyers of new battery-electric vehicles less satisfied with sales experience

There is a large disparity in satisfaction among buyers of battery-electric vehicles (BEVs) and buyers of internal combustion engine (ICE) vehicles.

J.D. Power indicated the overall buyer satisfaction index is 54 points lower for BEVs (790) than for traditional gasoline-powered vehicles (844). Experts explained a cause for this is dealership personnel vehicle knowledge/expertise, with more than a full point difference in sales satisfaction between BEV buyers (7.59 on a 10-point scale) and gasoline buyers (8.72).

“BEV buyers are a unique challenge for dealers,” Sutton said. “As manufacturers ready new model launches, now is the time to ramp up training and knowledge of BEVs and related services — such as charging and aftersales requirements — as buyers will undoubtedly have more questions about them.”

— Remote buyers more satisfied with digital retailing

The study found that, among those buyers who are willing and able to purchase their vehicle without having to physically visit their selling dealer, satisfaction is much higher in both the premium and mass market segments than among those buyers who go to the dealership.

“The ‘Amazon effect’ of seeing, buying and having a product delivered to your doorstep has made its way into vehicle buying and it is here to stay,” Sutton said.

— Tesla’s unofficial score improved from 2020

J.D. Power said Tesla received an SSI score of 815, an increase from its unofficial score of 804 a year ago.

The automaker is not officially ranked among other brands in the study because it doesn’t meet ranking criteria. Unlike other manufacturers, Tesla doesn’t grant J.D. Power permission to survey its owners in 15 states where it is required.

However, Tesla’s score was calculated based on a sample of surveys from owners in the other 35 states, according to J.D. Power.

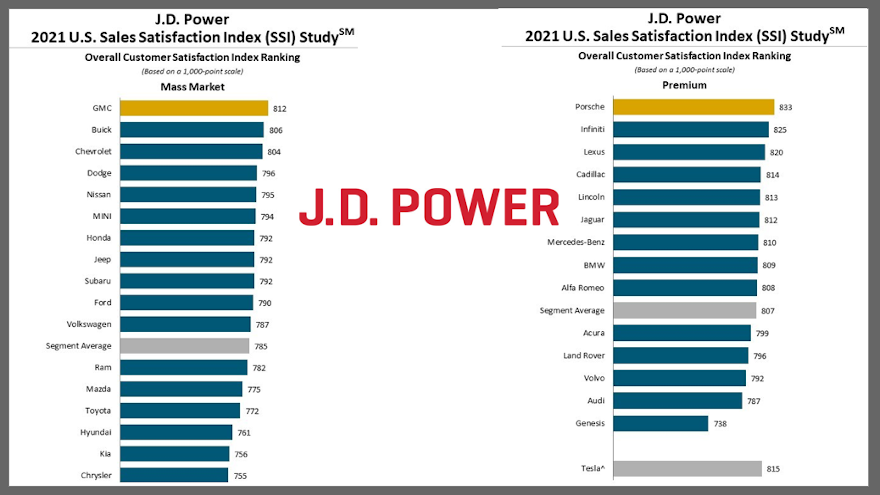

J.D. Power highlighted that Porsche ranked highest in satisfaction with dealer service among premium brands with a score of 833. Infiniti (825) ranked second, followed by Lexus (820), Cadillac (814) and Lincoln (813).

J.D. Power then reported that GMC ranked highest in satisfaction with dealer service among mass market brands with a score of 812. Buick (806) came in second, followed by Chevrolet (804), Dodge (796) and Nissan (795).

Brands showing the greatest improvement in satisfaction scores year-over-year included Jeep (up 24 points), Chevrolet (up 17 points), Dodge (up 17 points) and Ram (up 14 points).

Now in its 36th year, J.D. Power recapped that the U.S. Sales Satisfaction Index (SSI) Study measures satisfaction with the sales experience among new-vehicle buyers and rejecters (those who shop a dealership and purchase elsewhere).

The firm explained buyer satisfaction is based on six factors (in order of importance):

— Delivery process (28%)

— Dealer personnel (21%)

— Working out the deal (19%)

— Paperwork completion (19%)

— Dealership facility (10%)

— Dealership website (4%)

J.D. Power then noted that rejecter satisfaction is based on five factors:

— Salesperson (40%)

— Price (23%)

— Facility (15%)

— Variety of inventory (12%)

— Negotiation (10%)

J.D. Power also said the 2021 U.S. Sales Satisfaction Index (SSI) Study is based on responses from 35,387 buyers who purchased or leased their new vehicle from March through May.

“The study is a comprehensive analysis of the new-vehicle purchase experience and measures customer satisfaction with the selling dealer (satisfaction among buyers),” J.D. Power said. “The study also measures satisfaction with brands and dealerships that were shopped but ultimately rejected in favor of the selling dealership (satisfaction among rejecters).

The firm mentioned the study was fielded from July through September.

For more information about the U.S. Sales Satisfaction Index (SSI) Study, visit https://www.jdpower.com/business/automotive/us-sales-satisfaction-index-ssi-study.