ANALYSIS: Premium & mass market brands hold very different attitudes about CPO opportunities in wake of pandemic

Charts courtesy of J.D. Power.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

While certified pre-owned (CPO) programs appear to be more important than ever for executives of mass market and premium brands given production disruptions that have limited supply of new vehicles, two distinct narratives are playing out, according to a recent Voice of the Experts (VoE) report from the J.D. Power Valuation Services group.

Most premium manufacturers are doubling down on their CPO strategies, working more closely with their dealership communities to aggressively promote their programs. It is seen as an essential effort to ensure high-quality vehicles are available in showrooms to provide good options for prospective buyers who are not finding what they are looking for — at prices they are willing to pay — in their “new-vehicle” inventory.

On the mass market front, the picture is mixed. While some brands have focused on maintaining the standards that have clearly separated CPO from regular used-vehicle stock, others are expanding their programs by extending qualification requirements to include older vehicles with higher mileage. Enhancing conventional CPO programs with these new certified tiers are helping to increase the number of vehicles that are eligible in a market continually faced with inventory constraints.

The study was based on in-person interviews with CPO executives across 11 brands, with premium segment executives representing 45% of respondents and the mass market segment accounting for 55% of respondents.

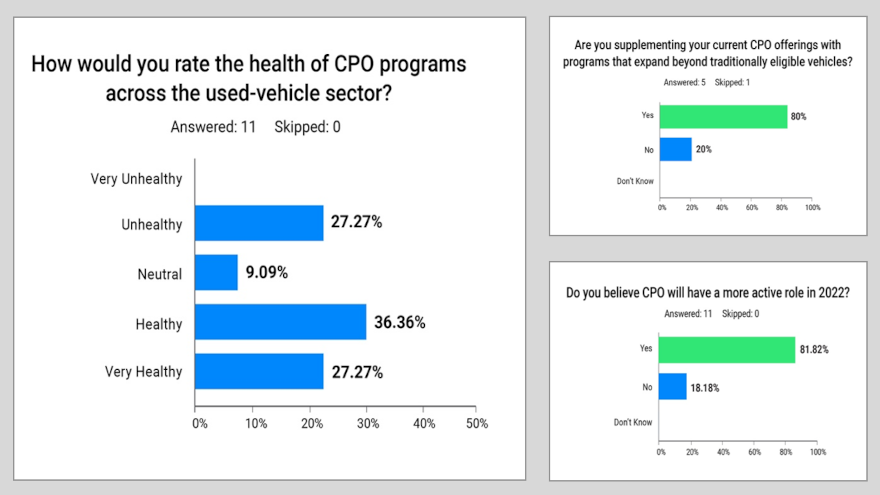

Despite the current business environment, 64% of all executives surveyed characterized the CPO market as being in a “healthy or very healthy” state. However, a closer look reveals important differences between premium and mass market brands. Half of the mass market executives interviewed found the CPO environment to be in an “unhealthy” state, with no one in the premium category agreeing with this negative assessment.

Interestingly, the availability of CPO-eligible vehicles was not the cause of negative sentiment. This was true even among the mass market brands. More than 90% of all respondents said they had no problems finding eligible inventory for their initiatives.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The main concern expressed revolved around dealership engagement. Two-thirds (67%) of mass market respondents pointed to challenges with securing committed participation in CPO programs. During the conversational portions of the interviews, executives for mass market brands indicated that many dealerships were so busy filling demand backlogs for regular used vehicles that they were not taking the time to go through the certification process.

The opposite view was held by nearly all premium brand executives. In this segment, 80% stated that delivering on the brand promise of their offerings — especially when positioning CPO as an alternative to a new-vehicle purchase — was a priority shared with their top dealerships.

It is a point that manifested itself on questions about how well dealerships are converting used-vehicle inventory for the CPO market. While 33% of executives for mass market brands stated that dealerships were doing a good job of harvesting CPO-eligible inventory, the number almost doubled (60%) among executives of premium brands.

Looking forward

With regards to the future, 60% of executives for premium brands say they intend to stay the course with current standards and procedures. Among those who stated plans to adjust their strategy, those changes primarily focused on enhancing promotion and advertising initiatives to raise awareness of their CPO programs.

By contrast, every executive for mass market brands said that significant changes to programs were underway to optimize and expand CPO-eligible inventory utilization through the rest of 2022 and beyond. A whopping 80% of these executives said they plan to supplement current CPO offerings with programs that expand beyond traditionally eligible vehicles.

In the final analysis, however, the importance of CPO programs was clear to all but two of the brands that participated in the survey. As the business landscape evolves, with new- and used-vehicle prices moving back from historic highs to more normalized pre-pandemic levels, executives stated that CPO will have an elevated role in the go-to-market strategies of both premium and mass market automotive manufacturers.

Ben Bartosch is manager of CPO solutions at J.D. Power and will be one of the speakers during Used Car Week, which begins on Nov. 14 in San Diego.