Carvana races to record-breaking Q3, and is still picking up speed

Image courtesy of Carvana.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Carvana is moving full speed ahead — and still accelerating.

The online used-car retailer announced its financial results for the third quarter of 2024 this week, showing “record performance in virtually every key financial measure,” according to its letter to shareholders.

Those measures include a net income of $148 million with a net income margin of 4%, GAAP operating income of $337 million, $429 million in adjusted EBITDA and an adjusted EBITDA margin of 11.7%, which the company said is the best ever for a public automotive retailer.

As a result, the company has adjusted its earnings guidance upward, saying in a news release it now projects its adjusted EBITDA for the full year of 2024 to be “significantly above the high end” of its previous target range of $1 billion-$1.2 billion.

“Carvana’s exceptional results underscore our position as the fastest-growing and most profitable automotive retailer,” founder and CEO Ernie Garcia said in the letter. “Our progress in Q3 further highlights the strength of our vertically integrated business model and also begins to demonstrate the power of our unique infrastructure, including the ADESA network.

“As we integrate our operations and tap our national footprint, we are not only driving efficient growth but also improving customer experiences, reducing costs and strengthening our wholesale platform. With just 1% share in an enormous market, significant capacity to support growth, and a business that generates positive feedback as it scales, we are just getting started.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Garcia’s optimism is fueled in large part because Carvana is just beginning to tap into ADESA’s 56 auction sites as assets in its used-vehicle retail operation.

During Q3, Carvana opened its first two Megasites, adding inspection and reconditioning center capabilities to auction sites at ADESA Kansas City and ADESA Houston, boosting the retail operations in those markets.

In early October, the company announced a third Megasite coming to ADESA Las Vegas.

Garcia said the company’s acquisition of the ADESA auctions in 2022 was made “with the belief that combining Carvana’s e-commerce model with ADESA’s physical wholesale auction business would accelerate our path to becoming the largest and most profitable automotive retailer.”

As the integration between the retail and wholesale parts of the business ramps up, he said, “the power of this combination is apparent.”

“Over time,” Garcia said, “the continued integration will improve our customer experience for Carvana customers, enhance ADESA’s offering to its commercial customers and strengthen our role in the automotive industry by adding complementary services and partnerships that are only enabled by vertical integration.”

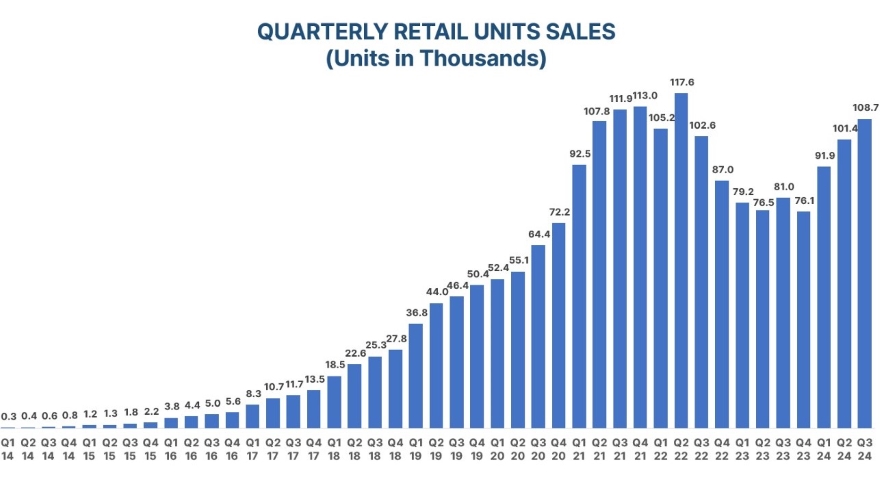

The early returns are indeed promising. Carvana reported sales of 108,651 retail units for the three months ending Sept. 30, up 34% from Q3 2023 and total revenue of $3.655 billion, a 32% year-over-year leap.

And the company said those numbers are likely to rise again in Q4, saying it expects a sequential YOY increase in retail unit sales.

“The pieces are all in place,” Garcia said. “We are a team that knows how to build. We have an offering customers love. We have a uniquely profitable and highly scalable business model. And we have already built, acquired and invested in the most complex and expensive parts of the infrastructure necessary to be many multiples larger than we are today.

“Our existing reconditioning infrastructure can support annual production capacity of over 1 million retail units and our real estate footprint can support annual production capacity of over 3 million retail units. … We remain firmly on the path to buying and selling millions of cars, to becoming the largest and most profitable automotive retailer, and to fulfilling our mission of changing the way people buy and sell cars.”