Kontos on why the wholesale market is a ‘perfect drought’

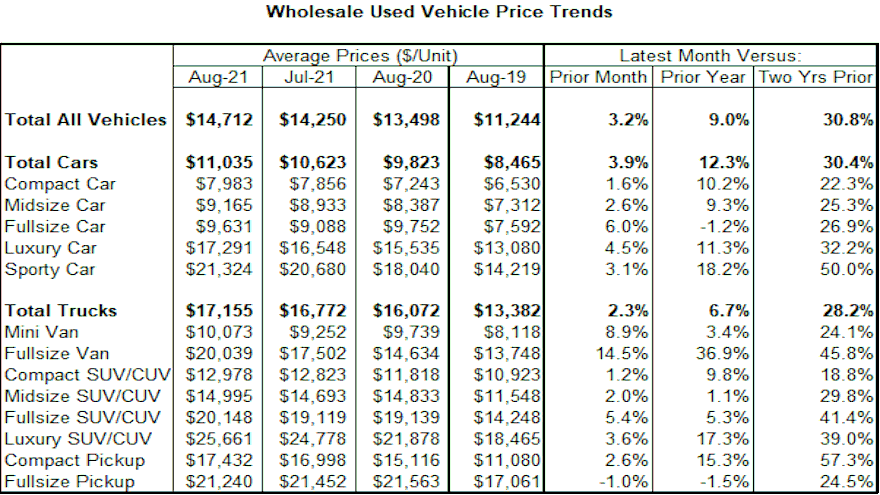

Chart courtesy of KAR Global.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

CARMEL, Ind. –

Perhaps the opposite of the “perfect storm” is the “perfect drought.”

The latter term is what KAR Global chief economist Tom Kontos used to describe what’s happening in the wholesale market, especially when it comes to prices and supply.

According to KAR Global Analytical Services’ monthly analysis of wholesale used-vehicle prices by vehicle model class, analysts found that wholesale prices in August averaged $14,712. That’s 3.2% higher compared to July and 9.0% higher year-over-year. The August reading also is a whopping 30.8% above August 2019 and pre-COVID-19 circumstances.

Kontos explained his thinking behind his newest wholesale market analogy as a part of the newest Kontos Kommentary released on Wednesday.

“The two-month decline in average wholesale prices ended in August, with prices recovering thus far in September to peak levels achieved during the spring. The continued chip shortage on the new-car side and the ‘perfect drought’ in supply on the used-car side are the main reasons for this,” said Kontos, who is among the more than 140 experts and executives set to appear during Used Car Week, which begins on Nov. 15 in Las Vegas.

“However, retail used-vehicle sales and CPO sales have softened not only because of used-vehicle supply shortages that limit vehicle selection, but consumer awareness of high used vehicle prices that may lead some shoppers to delay their purchases,” he continued.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“All model class segments except full-size pickups showed month-over-month increases in average prices. The declines to average pickup truck prices were modest and from high levels,” Kontos went on to say.

Kontos also touched on KAR Global’s latest data using criteria that often characterize off-lease units.

When holding constant for sale type, model-year-age, mileage, and model class segment, Kontos noted prices in August were up significantly year-over-year and compared to August 2019 for both midsize cars and midsize SUV/CUVs.

Prices for those midsize cars came in at $17,946, up by 31.2%, while values for those midsize SUV/CUVs rose 22.7% compared to a year ago to land at $28,321.