Lane watch: Developments connected to affordability surface at auctions, too

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Experts at Edmunds, Equifax and TransUnion all touched on car affordability in the past 10 days when analyzing the financing and retailing scenes.

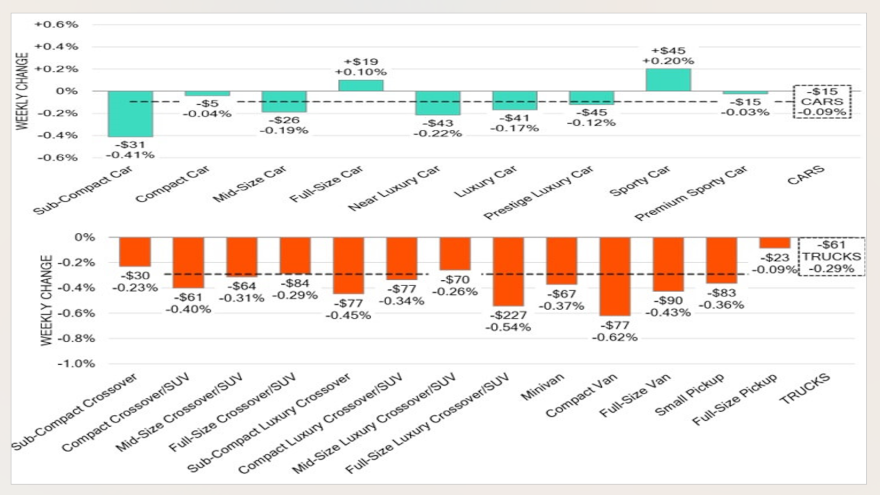

The topic surfaced again on Tuesday when Black Book discussed how wholesale prices dropped another 0.24% last week; an amount more than double what lane watchers recorded a week earlier.

“The wholesale market experienced a downtrend for most vehicle types last week, except for full-size car and sporty car (segments), which continued to increase,” Black Book said in its latest installment of Market Insights.

“Another trend that we have noticed is a small decline in auction inventory and noticeably in the dealer lanes,” analysts continued in their report. “This could happen because dealers are keeping more of their trade-ins rather than bringing them to the auction.”

Older trade-ins are what Edmunds director of insights Ivan Drury said could be key to helping dealers cater to potential buyers looking for more affordable transportation.

Affordability is also what Angelica Jeffreys of Equifax noted as primary component to what could make for a successful or challenging summertime sales season that’s set to begin with Memorial Day weekend straight ahead.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Furthermore, Satyan Merchant of TransUnion pointed to affordability as a primary headwind that’s kept auto-finance portfolios from growing more rapidly.

As a result, perhaps dealers are procuring inventory elsewhere or standing pat with what’s already on their lots because Black Book reported the average auction sales rate last week dropped to 56%, dipping 1% from the previous week.

“Although there was some reduction in auction inventory, the volumes being sold by the larger sellers, especially in the OEM lanes, are reminiscent of those seen pre-COVID,” analysts said.

No matter the consignor type, the ones that sent sports cars down the lanes saw prices rise another 0.20%, representing the eighth consecutive week of gains for those summertime rides. Black Book computed that the segment has generated a weekly increase of 0.32% during that stretch.

But those sports cars might be for buyers with more disposable income and financial resources. Black Book returned to the affordability conversation when continuing its analysis of the car space, mentioning that values for subcompact cars decreased another 0.41% last week.

That movement marked the sixth week in a row of declines for subcompact cars, with an average weekly drop of 0.37%, according to Black Book tracking.

“Although these vehicles are considered ‘affordable,’ the segment witnessed only four weeks of increases in April,” analysts continued about sub-compact cars. “In contrast, its larger counterpart, the compact car, experienced a streak of 17 consecutive weeks of growth before seeing a slowdown.”

Meanwhile, in the truck department, Black Book watched all 13 segments soften for the first time since the middle of January, dropping 0.29% overall.

Caught up in that situation were full-size crossover/SUVs, as analysts said their 10 straight weeks of value rises ended with a 0.29% decrease.

Black Book elaborated about what’s happening with vans.

“Full-size vans have consistently depreciated over the past seven weeks, with an average weekly decline of 1.00%,” analysts said. “Although the compact van segment has also been depreciating, it has been doing so at a slower pace. Nevertheless, last week saw an increase in the rate of decline for compact vans, falling by 0.62%, a notable increase from the previous week’s decrease of 0.13%.”

With the industry moving toward a holiday weekend and dealers trying to satisfy customers, Black Book reiterated “as always, our team of analysts is focused on keeping their eyes on the market for developing trends and gathering insight.”