Lane watch: Impact of new-car incentives already seeping into wholesale

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

As perhaps the consumer search for affordable vehicles continues, the overall status of the wholesale market appears to be stable, stemming from the latest update from Black Book released on Tuesday afternoon.

Black Book highlighted that the wholesale market had a deceleration in the rate of depreciation during the first full week of August compared to the majority of July since prices decreased 0.32% overall. That’s 1 basis point less than a week earlier.

Analysts pointed out that the auction conversion rate remains high, with last week’s rate coming in at 58%.

Black Book also noted the estimated used retail days to turn decreased slightly to roughly 48 days.

Furthermore, the newest installment of Market Insights mentioned how what’s happening on the new-car side is already seeping into the auction world.

“Black Book analysts have identified a significant trend: the depreciation of 2024 model year vehicles,” Black Book said in the report. “The introduction of rebates and substantial dealer incentives for new 2024 model year cars have precipitated a downturn in the auction values of their used counterparts.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

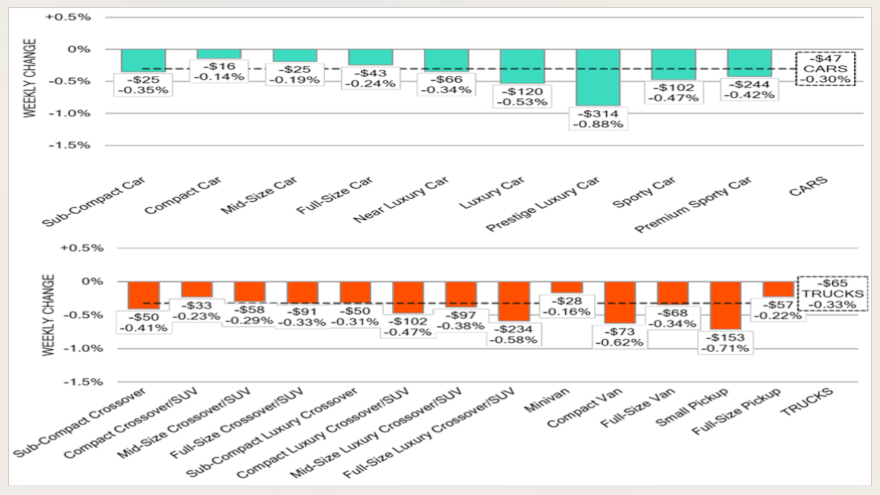

Maybe those incentives from automakers and their captives are being slapped on the hoods most often for prestige luxury cars since Black Book reported prices for those vehicles softened by 0.88%, which was the largest decrease for any segment last week. During the past four weeks, Black Book indicated this segment has averaged a weekly depreciation of 0.73%.

And OEMs might be trying to incentivize small pickups since Black Book watched wholesale prices for those units drop by 0.71% a week ago. Over the past month, analysts said this segment has averaged a weekly depreciation rate of 0.88%.

Meanwhile, prices for late-model compact cars and midsize cars are on the rise.

Black Book reported values for compact cars less than 2 years old climbed by 0.41%, marking the second consecutive week of increases for this age group.

And analysts said prices midsize cars less than 2 years old increased another 0.14% last week following a “significant” gain of 0.68% recorded during the previous week.

Despite those movements, Black Book said values for all 22 vehicle segments decreased last week, leading to an overall dip of 0.30% for cars and 0.33% for trucks and SUVs.

“As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight,” Black Book said.