Lane watch: Spring market coming into bloom

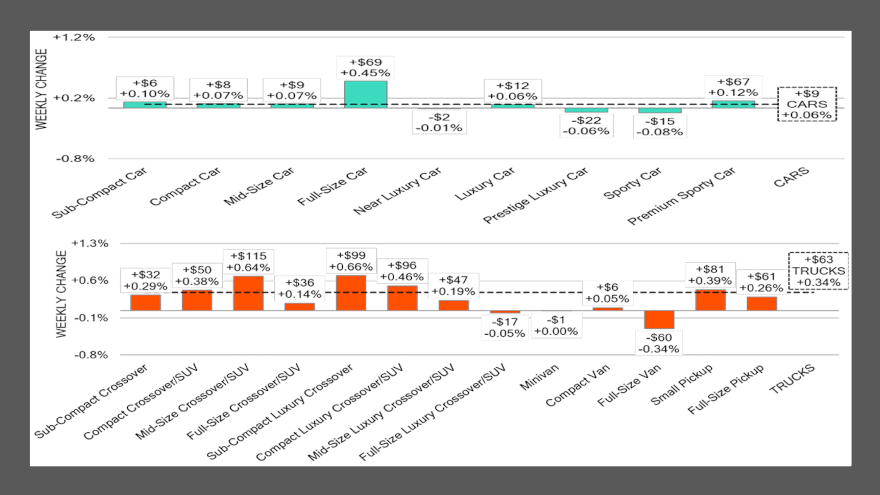

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The NCAA men’s and women’s basketball tournaments are unfolding, Major League Baseball just opened its season in Japan, and dealers are raising their hands and clicking buy buttons more often during physical and online auctions.

Yep, it’s spring.

According to Black Book’s newest edition of Market Insights, wholesale prices rose by 0.27%, and the conversion rate at auction hit another new high for the year, coming in at 66%.

Meanwhile, analysts noticed that their estimated used retail days-to-turn stayed at roughly 44 days.

“The market gained momentum last week, recording the largest single- week increase since early April of last year,” Black Book said in the report. “Bidder activity was strong nationwide, driven by discussions about tariffs — despite the one-month reprieve for the auto industry — and typical signs of a robust spring buying season, resulting in larger-than-usual increases.”

“Last week marked the first time this year that both the overall car and truck segments experienced positive movement,” analysts continued. “Over the past two weeks, we have observed a notable trend: previously Canadian vehicles being exported to the U.S. are experiencing price increases. However, the volume of these vehicles has declined compared to previous weeks.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“For the second consecutive week, we have recorded the highest conversion rates of the year,” Black Book went on to say. “Last week, we saw a 2% increase in rates compared to the previous week. Meanwhile, total auction inventory has remained relatively stable over the past few weeks.”

Looking deeper into the latest data, Black Book noticed values for cars going in opposite directions depending on the age.

Analysts said prices for cars up to 2 years old rose by 0.21%, while prices for cars between 8 and 16 years old softened by 0.25%.

While perhaps the smallest car segment by volume, Black Book watched values for full-size cars rise the most last week, climbing by 0.45%.

Analysts added that prices for compact cars ticked up for the first time in 23 weeks, edging up by 0.07%.

In the truck department, late model utilities drove the value gainers.

“The sub-compact luxury (up 0.66%) and midsize (up 0.64%) crossover/SUV segments for 2-to-8-year-old vehicles recorded the largest increases last week,” Black Book said. “Additionally, the sub-compact luxury segment led gains in the 0-to-2-year-old age group, also rising by 0.66%.”

Also note, Black Book spotted the first value gain for minivans since the last week of last March. In fact, prices for minivans less than 2 years old increased by 0.27%, according to Black Book tracking.

With some dealers filling out tournament brackets, getting ready to go to the ballpark and scouring the lanes for the inventory that will turn quickly during what’s left of tax season, Black Book reiterated, “As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight.”