Lane watch: Spring-market lift already starting to weaken

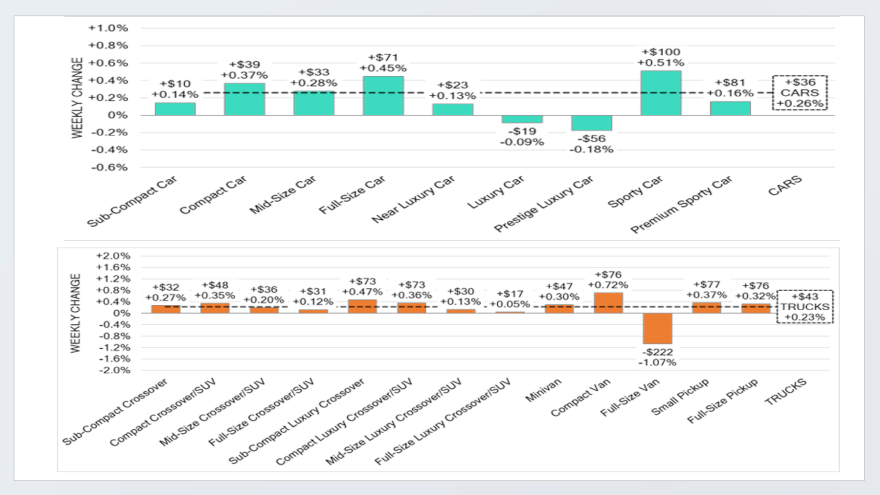

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Monday’s solar eclipse lasted less than five minutes. The duration of this year’s spring market doesn’t appear to be that short, but Black Book is already seeing signs of fading.

Analysts said wholesale prices still rose 0.24% last week, but that wasn’t as much as the 0.39% lift Black Book recorded a week earlier.

“The conversion rate also experienced a minor decline, reflecting heightened buyer prudence following a period of quick price escalation,” Black Book said in its latest installment of Market Insights released on Tuesday. “For context, the equivalent week before the onset of COVID-19 witnessed a much smaller increase of 0.09%.

“With the first week in April in the books, the continued upward trend in wholesale prices suggests that demand remains strong, keeping prices high,” analysts continued in the report. “The decline in auction conversion rates, which signifies a lower percentage of vehicles being sold at auctions, could imply that the demand may be starting to soften or that buyers are becoming more selective, likely due to the higher prices commanded in recent weeks.”

Black Book indicated prices for seven of nine car segments increased last week, pushing overall car values higher by 0.26% on a volume-weighted basis.

Analysts determined prices for cars up to 2 years old rose 0.25%, while prices for cars 8 to 16 years old ticked up 0.22%.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

As often happens in spring, Black Book noticed values in the sporty car segment made a notable higher. In fact, the jump of 0.51% for those warmer weather units paced the car gains.

Meanwhile, Black Book the prestige luxury car segment keeps depreciating, with those cars sliding another 0.18% last week. The value drop a week earlier for prestige luxury cars was 0.51%, according to Black Book tracking.

In the truck department, Black Book pegged the overall value rise for trucks on a volume-weighted basis at 0.23%. A week earlier, analysts said truck prices rose 0.41%.

While values for 8- to 16-year-old trucks remained flat, Black Book said prices for models up to 2 years old ticked up by 0.11% on average last week.

Analysts indicated values for 12 of 13 truck segments increased last week with compact vans leading the way with a jump of 0.72%.

Conversely, full-size vans were the lone truck segment to experience a price decline, tumbling by 1.07% last week after Black Book tracking had them dropping by 0.74% a week earlier.

Whether it’s watching the solar system or wholesale prices, Black Book reiterated, “as always, our team analysts are focused on keeping their eye on the market for development trends and gathering insight.”