Kontos: Prices keep climbing for vehicles ripe to certify

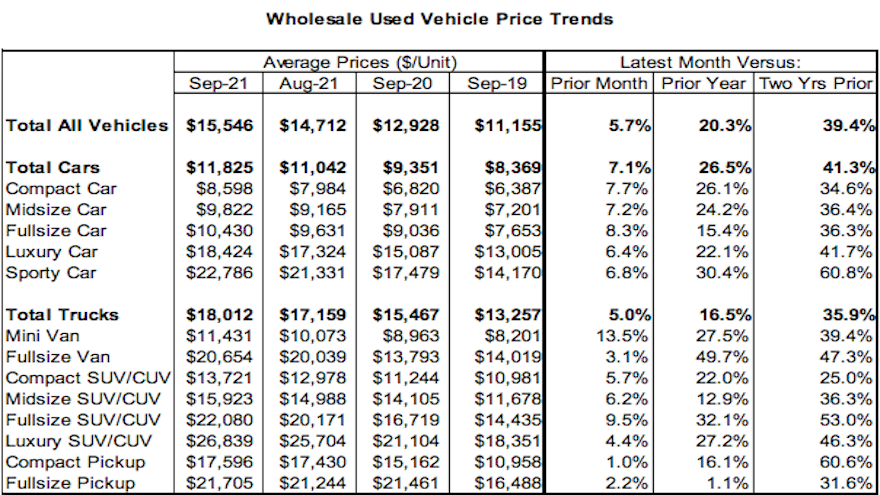

Chart courtesy of KAR Global.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

CARMEL, Ind. –

KAR Global chief economist Tom Kontos elaborated a bit in his newest Kontos Kommentary about a primary way franchised dealerships have been able to satisfy their customers who wanted a new model that simply wasn’t available.

“Retail used-vehicle sales softened modestly in September, but CPO sales have remained strong, as these vehicles represent the closest substitute to new vehicles lacking in availability due to the chip shortage,” Kontos said.

If used-car managers can secure vehicles that are primed to be certified, they’re likely paying quite a premium price for those units within the wholesale market based on KAR Global Analytical Services’ monthly analysis of wholesale used-vehicle prices by model class.

As he does each month, Kontos examined prices for 3-year-old midsize cars and midsize SUV/CUVs with less than 45,000 on the odometer,

Using criteria that characterize off-lease units and when holding constant for sale type, model-year-age, mileage, and model class segment, Kontos indicated prices for those particular midsize cars spiked 44.6% year-over-year to $19,096. Prices for those specific midsize SUV/CUVs jumped 33.5% year-over-year to $29,600.

Looking at the entire wholesale market, Kontos pointed out that prices are rising at similar paces.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

According to KAR, wholesale prices in September averaged $15,546. That’s up 5.7% compared to August and 20.3% higher than September of last year. The reading is 39.4% above the pre-COVID reading registered in September 2019.

“Wholesale prices continued to climb to new highs in September and early October, as supply remains tight and demand high,” Kontos said in his latest analysis. “Overall, average auction prices cracked the $16,000 mark for the first time ever during the week of Sept. 27 and have exceeded that level through Oct. 17.”

A video version of Kontos’ analysis can be seen here.