With wholesale prices still surging, KAR unveils ‘% to Retail’ feature

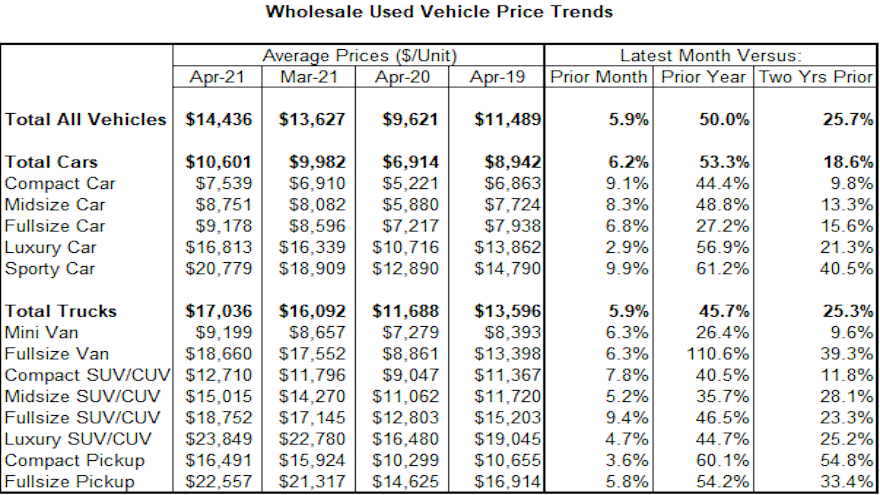

Chart courtesy of KAR Global.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

CARMEL, Ind. –

Data contained in the newest Kontos Kommentary might have reinforced value of the latest functionality of ADESA’s platform to help dealers still be profitable during times of unprecedented wholesale prices.

Coinciding with the launch of the company’s proprietary “% to Retail” tool, KAR Global chief economist Tom Kontos said average wholesale vehicle prices cracked the $14,000 mark for the first time ever in April, and then proceeded to set new highs above $15,000 in May.

According to KAR Global Analytical Services’ monthly analysis of wholesale used vehicle prices by vehicle model class, wholesale prices in April averaged $14,436 — up 5.9% compared to March 50.0% above the reading in April 2020, and 25.7% higher when compared to pre-COVID/April 2019

“This is the latest sign of the seemingly never-ending rise in wholesale values resulting from a deluge in demand and a drought in supply,” Kontos said in his latest analysis.

“Retail used vehicle and CPO sales did slow down a bit in April, but it is unclear if sales were limited by demand or supply and nevertheless remained high,” he continued.

With those metrics in mind, KAR Global also announced that all 24/7 bid/buy vehicle listings on ADESA’s digital marketplace now showcase the current bid of the vehicle compared to the estimated national used retail market price.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

KAR highlighted “% to Retail” is powered by autoniq, a sister company to ADESA and a provider of app-based vehicle pricing and evaluation information.

According to a company news release, the new feature is aimed at helping dealers quickly analyze vehicle pricing and make better-informed decisions on the best inventory for their lot.

“Our customers are experiencing unusual market dynamics across North America, so having instant access to real-time intelligence on vehicle valuation has never been more helpful and important,” said John Hammer, chief commercial officer of KAR Global and president of ADESA. “With the ‘% to Retail’ feature, we’re making it easier and faster for dealers to identify vehicles priced right for their wholesale-to-retail strategy.

Our digital marketplaces are expanding the pool of fresh inventory accessible to buyers, and ‘% to Retail’ will help them make better, faster and smarter bidding and buying decisions,” Hammer continued.

The company explained the “% to Retail” functionality uses KAR’s proprietary data science capabilities to evaluate data from across ADESA and KAR’s other digital marketplaces along with the latest industry, market and economic data to accurately estimate potential vehicle profitability. Buyers can filter their searches on ADESA by “% to Retail” range to focus their bidding and buying on vehicles within a particular range — and each listing will tell the dealer the estimated margin between the wholesale price/bid and the estimated retail sale.

KAR indicated that vehicles with a lower percentage to retail present the greatest opportunity for retail profit while those with higher percentages are closer to the estimated retail market price.

The company also mentioned search capabilities allow buyers to sort and/or filter vehicles by additional specifications like proximity, make and model, and condition to showcase all vehicles that are available.

“Dealers who piloted the ‘% to Retail’ functionality consistently found it easy to use and beneficial for finding the best, most competitively priced vehicles,” said Rick Griskie, president of digital marketplaces at KAR Global.

“This new feature allows our dealers to find the exact inventory that supports their overall retail strategy, and we’ve already seen early success with our dealers using the tool showing a 20% higher success rate in finding vehicles to purchase compared to those who did not use the tool,” Griskie went on to say.

Kontos pointed out another tidbit within the company’s latest data set that might reinforce the value of the ‘% to Retail’ functionality.

“Interestingly, compact cars and full-size SUVs/CUVs both had month-over-month increases of above 9%, exemplifying the breadth of demand across all used-vehicle segments, small and large,” said Kontos, who also offered his perspective through a video that can be seen here.

And Kontos also recently appeared on the Auto Remarketing Podcast to discuss the "perfect storm" impacting the wholesale market and more. That episode is available below.